Regularised regression

Overview

Teaching: 110 min

Exercises: 60 minQuestions

What is regularisation?

How does regularisation work?

How can we select the level of regularisation for a model?

Objectives

Understand the benefits of regularised models.

Understand how different types of regularisation work.

Apply and critically analyse regularised regression models.

Introduction

This episode is about regularisation, also called regularised regression or penalised regression. This approach can be used for prediction and for feature selection and it is particularly useful when dealing with high-dimensional data.

One reason that we need special statistical tools for high-dimensional data is that standard linear models cannot handle high-dimensional data sets – one cannot fit a linear model where there are more features (predictor variables) than there are observations (data points). In the previous lesson, we dealt with this problem by fitting individual models for each feature and sharing information among these models. Now we will take a look at an alternative approach that can be used to fit models with more features than observations by stabilising coefficient estimates. This approach is called regularisation. Compared to many other methods, regularisation is also often very fast and can therefore be extremely useful in practice.

First, let us check out what happens if we try to fit a linear model to high-dimensional

data! We start by reading in the methylation

data from the last lesson:

library("here")

library("minfi")

methylation <- readRDS(here("data/methylation.rds"))

## here, we transpose the matrix to have features as rows and samples as columns

methyl_mat <- t(assay(methylation))

age <- methylation$Age

Then, we try to fit a model with outcome age and all 5,000 features in this dataset as predictors (average methylation levels, M-values, across different sites in the genome).

# by using methyl_mat in the formula below, R will run a multivariate regression

# model in which each of the columns in methyl_mat is used as a predictor.

fit <- lm(age ~ methyl_mat)

summary(fit)

Call:

lm(formula = age ~ methyl_mat)

Residuals:

ALL 37 residuals are 0: no residual degrees of freedom!

Coefficients: (4964 not defined because of singularities)

Estimate Std. Error t value Pr(>|t|)

(Intercept) 2640.474 NaN NaN NaN

methyl_matcg00075967 -108.216 NaN NaN NaN

methyl_matcg00374717 -139.637 NaN NaN NaN

methyl_matcg00864867 33.102 NaN NaN NaN

methyl_matcg00945507 72.250 NaN NaN NaN

[ reached getOption("max.print") -- omitted 4996 rows ]

Residual standard error: NaN on 0 degrees of freedom

Multiple R-squared: 1, Adjusted R-squared: NaN

F-statistic: NaN on 36 and 0 DF, p-value: NA

You can see that we’re able to get some effect size estimates, but they seem very high! The summary also says that we were unable to estimate effect sizes for 4,964 features because of “singularities”. We clarify what singularities are in the note below but this means that R couldn’t find a way to perform the calculations necessary to fit the model. Large effect sizes and singularities are common when naively fitting linear regression models with a large number of features (i.e., to high-dimensional data), often since the model cannot distinguish between the effects of many, correlated features or when we have more features than observations.

Singularities

The message that

\[(X^TX)^{-1}X^Ty,\]lm()produced is not necessarily the most intuitive. What are “singularities” and why are they an issue? A singular matrix is one that cannot be inverted. R uses inverse operations to fit linear models (find the coefficients) using:where $X$ is a matrix of predictor features and $y$ is the outcome vector. Thus, if the matrix $X^TX$ cannot be inverted to give $(X^TX)^{-1}$, R cannot fit the model and returns the error that there are singularities.

Why might R be unable to calculate $(X^TX)^{-1}$ and return the error that there are singularities? Well, when the determinant of the matrix is zero, we are unable to find its inverse. The determinant of the matrix is zero when there are more features than observations or often when the features are highly correlated.

xtx <- t(methyl_mat) %*% methyl_mat det(xtx)[1] 0

Correlated features – common in high-dimensional data

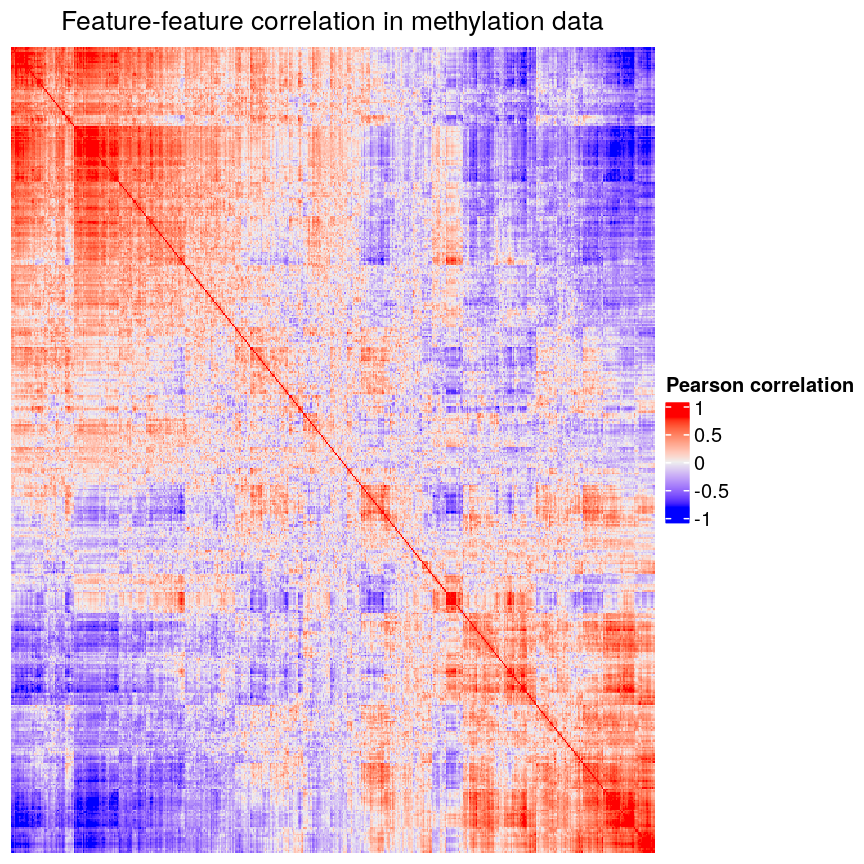

In high-dimensional datasets, there are often multiple features that contain redundant information (correlated features). If we visualise the level of correlation between sites in the

methylationdataset, we can see that many of the features represent the same information - there are many off-diagonal cells, which are deep red or blue. For example, the following heatmap visualises the correlations for the first 500 features in themethylationdataset (we selected 500 features only as it can be hard to visualise patterns when there are too many features!).library("ComplexHeatmap") small <- methyl_mat[, 1:500] cor_mat <- cor(small) Heatmap(cor_mat, column_title = "Feature-feature correlation in methylation data", name = "Pearson correlation", show_row_dend = FALSE, show_column_dend = FALSE, show_row_names = FALSE, show_column_names = FALSE )

Heatmap of pairwise feature-feature correlations between CpG sites in DNA methylation data

Challenge 1

Consider or discuss in groups:

- Why would we observe correlated features in high-dimensional biological data?

- Why might correlated features be a problem when fitting linear models?

- What issue might correlated features present when selecting features to include in a model one at a time?

Solution

- Many of the features in biological data represent very similar information biologically. For example, sets of genes that form complexes are often expressed in very similar quantities. Similarly, methylation levels at nearby sites are often very highly correlated.

- Correlated features can make inference unstable or even impossible mathematically.

- When we are selecting features one at a time we want to pick the most predictive feature each time. When a lot of features are very similar but encode slightly different information, which of the correlated features we select to include can have a huge impact on the later stages of model selection!

Regularisation can help us to deal with correlated features, as well as effectively reduce the number of features in our model. Before we describe regularisation, let’s recap what’s going on when we fit a linear model.

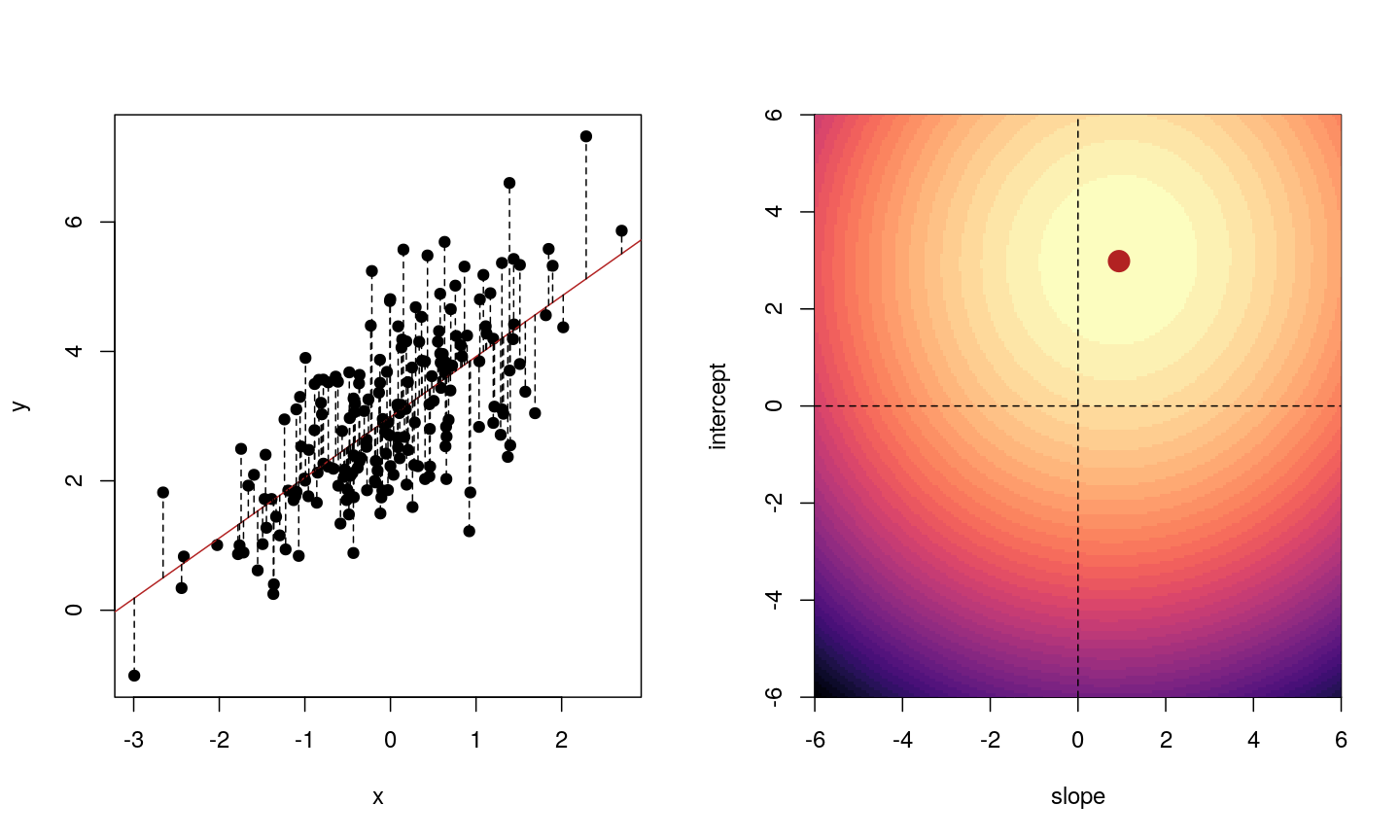

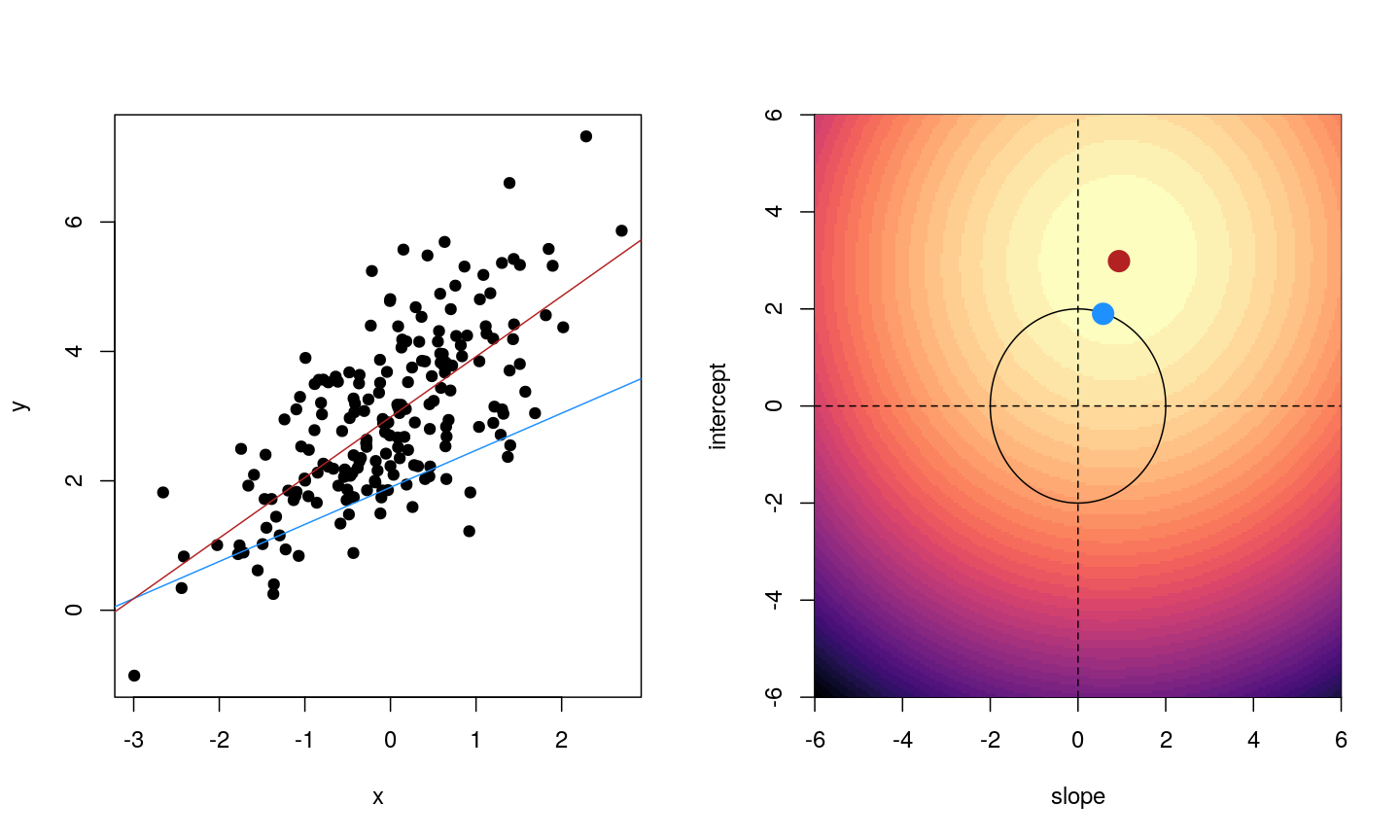

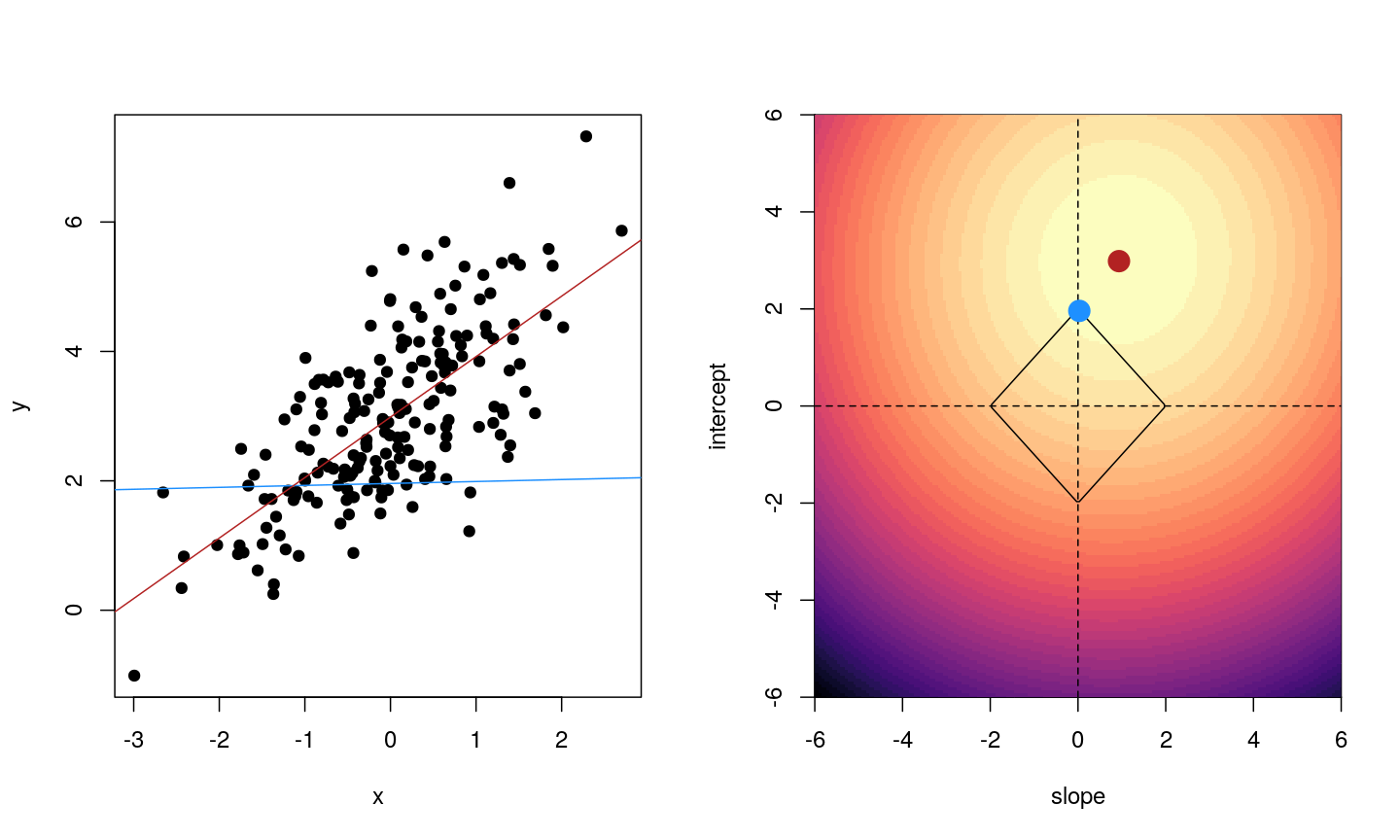

Coefficient estimates of a linear model

When we fit a linear model, we’re finding the line through our data that minimises the sum of the squared residuals. We can think of that as finding the slope and intercept that minimises the square of the length of the dashed lines. In this case, the red line in the left panel is the line that accomplishes this objective, and the red dot in the right panel is the point that represents this line in terms of its slope and intercept among many different possible models, where the background colour represents how well different combinations of slope and intercept accomplish this objective.

Illustrative example demonstrated how regression coefficients are inferred under a linear model framework.

Mathematically, we can write the sum of squared residuals as

\[\sum_{i=1}^N ( y_i-x'_i\beta)^2\]where $\beta$ is a vector of (unknown) covariate effects which we want to learn by fitting a regression model: the $j$-th element of $\beta$, which we denote as $\beta_j$ quantifies the effect of the $j$-th covariate. For each individual $i$, $x_i$ is a vector of $j$ covariate values and $y_i$ is the true observed value for the outcome. The notation $x’_i\beta$ indicates matrix multiplication. In this case, the result is equivalent to multiplying each element of $x_i$ by its corresponding element in $\beta$ and then calculating the sum across all of those values. The result of this product (often denoted by $\hat{y}_i$) is the predicted value of the outcome generated by the model. As such, $y_i-x’_i\beta$ can be interpreted as the prediction error, also referred to as model residual. To quantify the total error across all individuals, we sum the square residuals $( y_i-x’_i\beta)^2$ across all the individuals in our data.

Finding the value of $\beta$ that minimises the sum above is the line of best fit through our data when considering this goal of minimising the sum of squared error. However, it is not the only possible line we could use! For example, we might want to err on the side of caution when estimating effect sizes (coefficients). That is, we might want to avoid estimating very large effect sizes.

Challenge 2

Discuss in groups:

- What are we minimising when we fit a linear model?

- Why are we minimising this objective? What assumptions are we making about our data when we do so?

Solution

- When we fit a linear model we are minimising the squared error. In fact, the standard linear model estimator is often known as “ordinary least squares”. The “ordinary” really means “original” here, to distinguish between this method, which dates back to ~1800, and some more “recent” (think 1940s…) methods.

- Squared error is useful because it ignores the sign of the residuals (whether they are positive or negative). It also penalises large errors much more than small errors. On top of all this, it also makes the solution very easy to compute mathematically. Least squares assumes that, when we account for the change in the mean of the outcome based on changes in the income, the data are normally distributed. That is, the residuals of the model, or the error left over after we account for any linear relationships in the data, are normally distributed, and have a fixed variance.

Model selection using training and test sets

Sets of models are often compared using statistics such as adjusted $R^2$, AIC or BIC. These show us how well the model is learning the data used in fitting that same model 1. However, these statistics do not really tell us how well the model will generalise to new data. This is an important thing to consider – if our model doesn’t generalise to new data, then there’s a chance that it’s just picking up on a technical or batch effect in our data, or simply some noise that happens to fit the outcome we’re modelling. This is especially important when our goal is prediction – it’s not much good if we can only predict well for samples where the outcome is already known, after all!

To get an idea of how well our model generalises, we can split the data into two - a “training” and a “test” set. We use the “training” data to fit the model, and then see its performance on the “test” data.

Schematic representation of how a dataset can be divided into a training and a test set.

One thing that often happens in this context is that large coefficient values minimise the training error, but they don’t minimise the test error on unseen data. First, we’ll go through an example of what exactly this means.

To compare the training and test errors for a model of methylation features and age, we’ll split the data into training and test sets, fit a linear model and calculate the errors. First, let’s calculate the training error. Let’s start by splitting the data into training and test sets:

methylation <- readRDS(here::here("data/methylation.rds"))

library("SummarizedExperiment")

age <- methylation$Age

methyl_mat <- t(assay(methylation))

We will then subset the data to a set of CpG markers that are known to be associated with age from a previous study by Horvath et al.2, described in data.

cpg_markers <- c("cg16241714", "cg14424579", "cg22736354", "cg02479575", "cg00864867",

"cg25505610", "cg06493994", "cg04528819", "cg26297688", "cg20692569",

"cg04084157", "cg22920873", "cg10281002", "cg21378206", "cg26005082",

"cg12946225", "cg25771195", "cg26845300", "cg06144905", "cg27377450"

)

horvath_mat <- methyl_mat[, cpg_markers]

## Generate an index to split the data

set.seed(42)

train_ind <- sample(nrow(methyl_mat), 25)

## Split the data

train_mat <- horvath_mat[train_ind, ]

train_age <- age[train_ind]

test_mat <- horvath_mat[-train_ind, ]

test_age <- age[-train_ind]

Now let’s fit a linear model to our training data and calculate the training error. Here we use the mean of the squared difference between our predictions and the observed data, or “mean squared error” (MSE).

## Fit a linear model

# as.data.frame() converts train_mat into a data.frame

# Using the `.` syntax above together with a `data` argument will lead to

# the same result as using `train_age ~ train_mat`: R will fit a multivariate

# regression model in which each of the columns in `train_mat` is used as

# a predictor. We opted to use the `.` syntax because it will help us to

# obtain model predictions using the `predict()` function.

fit_horvath <- lm(train_age ~ ., data = as.data.frame(train_mat))

## Function to calculate the (mean squared) error

mse <- function(true, prediction) {

mean((true - prediction)^2)

}

## Calculate the training error

err_lm_train <- mse(train_age, fitted(fit_horvath))

err_lm_train

[1] 1.319628

The training error appears very low here – on average we’re only off by about a year!

Challenge 3

For the fitted model above, calculate the mean squared error for the test set.

Solution

First, let’s find the predicted values for the ‘unseen’ test data:

pred_lm <- predict(fit_horvath, newdata = as.data.frame(test_mat))The mean squared error for the test set is the mean of the squared error between the predicted values and true test data.

err_lm <- mse(test_age, pred_lm) err_lm[1] 223.3571

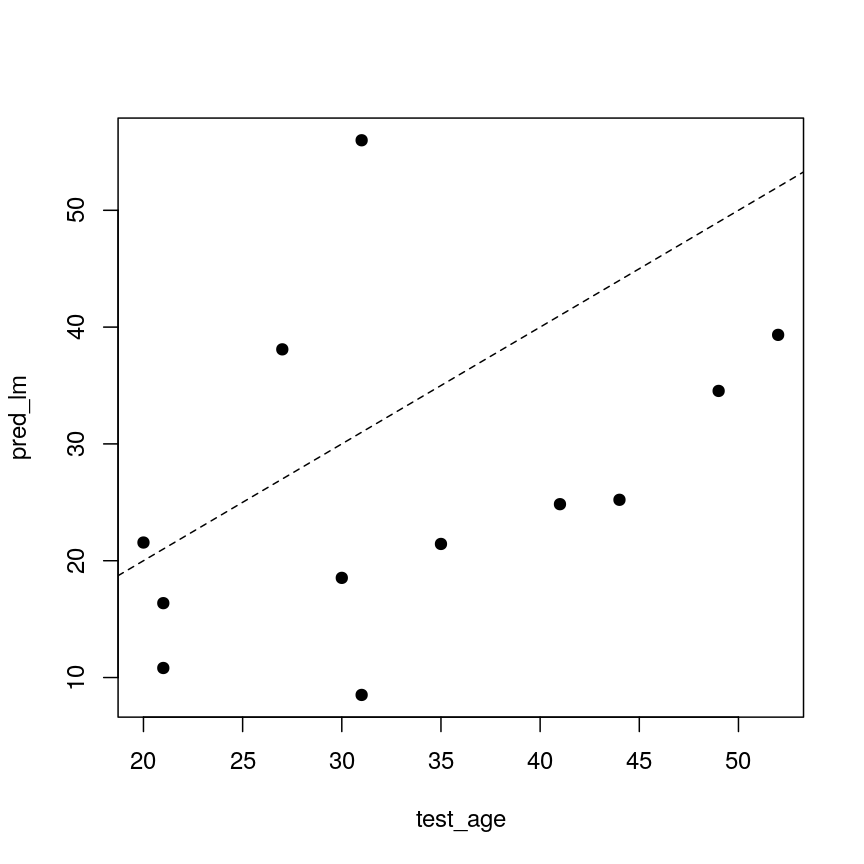

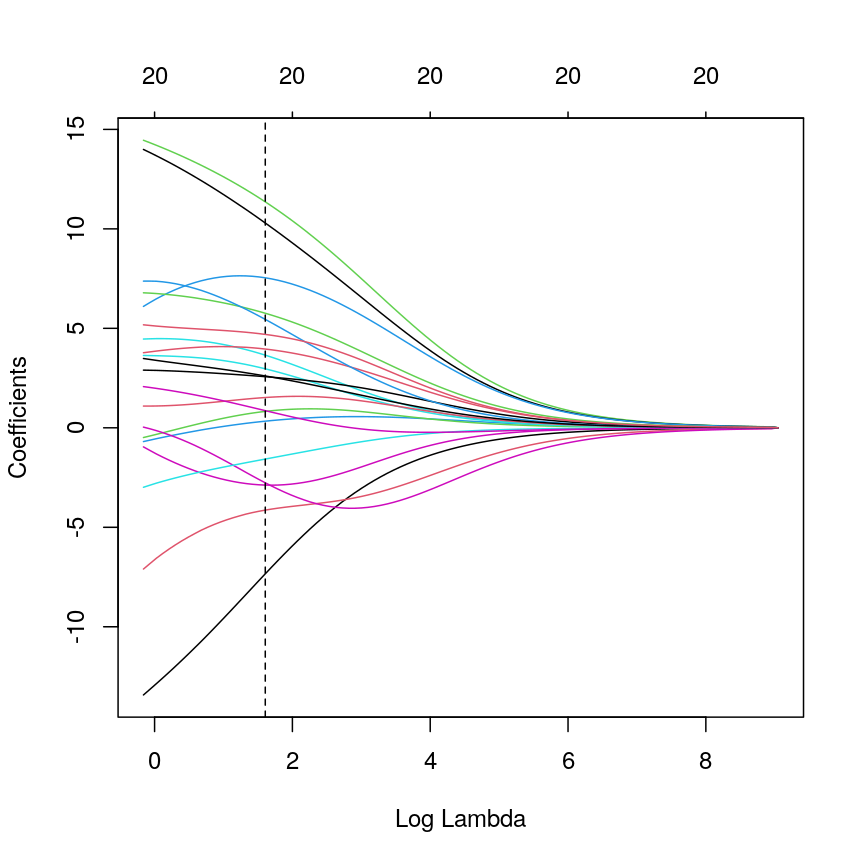

Unfortunately, the test error is a lot higher than the training error. If we plot true age against predicted age for the samples in the test set, we can gain more insight into the performance of the model on the test set. Ideally, the predicted values should be close to the test data.

par(mfrow = c(1, 1))

plot(test_age, pred_lm, pch = 19)

abline(coef = 0:1, lty = "dashed")

A scatter plot of observed age versus predicted age for individuals in the test set. Each dot represents one individual. Dashed line is used as a reference to indicate how perfect predictions would look (observed = predicted).

This figure shows the predicted ages obtained from a linear model fit plotted against the true ages, which we kept in the test dataset. If the prediction were good, the dots should follow a line. Regularisation can help us to make the model more generalisable, improving predictions for the test dataset (or any other dataset that is not used when fitting our model).

Regularisation

Regularisation can be used to reduce correlation between predictors, the number of features, and improve generalisability by restricting model parameter estimates. Essentially, we add another condition to the problem we’re solving with linear regression that controls the total size of the coefficients that come out and shrinks many coefficients to zero (or near zero).

For example, we might say that the point representing the slope and intercept must fall within a certain distance of the origin, $(0, 0)$. For the 2-parameter model (slope and intercept), we could visualise this constraint as a circle with a given radius. We want to find the “best” solution (in terms of minimising the residuals) that also falls within a circle of a given radius (in this case, 2).

Illustrative example demonstrated how regression coefficients are inferred under a linear model framework, with (blue line) and without (red line) regularisation. A ridge penalty is used in this example

Ridge regression

There are multiple ways to define the distance that our solution must fall in. The one we’ve plotted above controls the squared sum of the coefficients, $\beta$. This is also sometimes called the $L^2$ norm. This is defined as

\[\left\lVert \beta\right\lVert_2 = \sqrt{\sum_{j=1}^p \beta_j^2}\]To control this, we specify that the solution for the equation above also has to have an $L^2$ norm smaller than a certain amount. Or, equivalently, we try to minimise a function that includes our $L^2$ norm scaled by a factor that is usually written $\lambda$.

\[\sum_{i=1}^N \biggl( y_i - x'_i\beta\biggr)^2 + \lambda \left\lVert \beta \right\lVert_2 ^2\]This type of regularisation is called ridge regression. Another way of thinking about this is that when finding the best model, we’re weighing up a balance of the ordinary least squares objective and a “penalty” term that punishes models with large coefficients. The balance between the penalty and the ordinary least squares objective is controlled by $\lambda$ - when $\lambda$ is large, we want to penalise large coefficients. In other words, we care a lot about the size of the coefficients and we want to reduce the complexity of our model. When $\lambda$ is small, we don’t really care a lot about shrinking our coefficients and we opt for a more complex model. When it’s zero, we’re back to just using ordinary least squares. We see how a penalty term, $\lambda$, might be chosen later in this episode.

For now, to see how regularisation might improve a model, let’s fit a model using the same set

of 20 features (stored as cpg_markers) selected earlier in this episode (these

are a subset of the features identified by Horvarth et al), using both

regularised and ordinary least squares. To fit regularised regression models, we will use the glmnet package.

library("glmnet")

## glmnet() performs scaling by default, supply un-scaled data:

horvath_mat <- methyl_mat[, cpg_markers] # select the same 20 sites as before

train_mat <- horvath_mat[train_ind, ] # use the same individuals as selected before

test_mat <- horvath_mat[-train_ind, ]

ridge_fit <- glmnet(x = train_mat, y = train_age, alpha = 0)

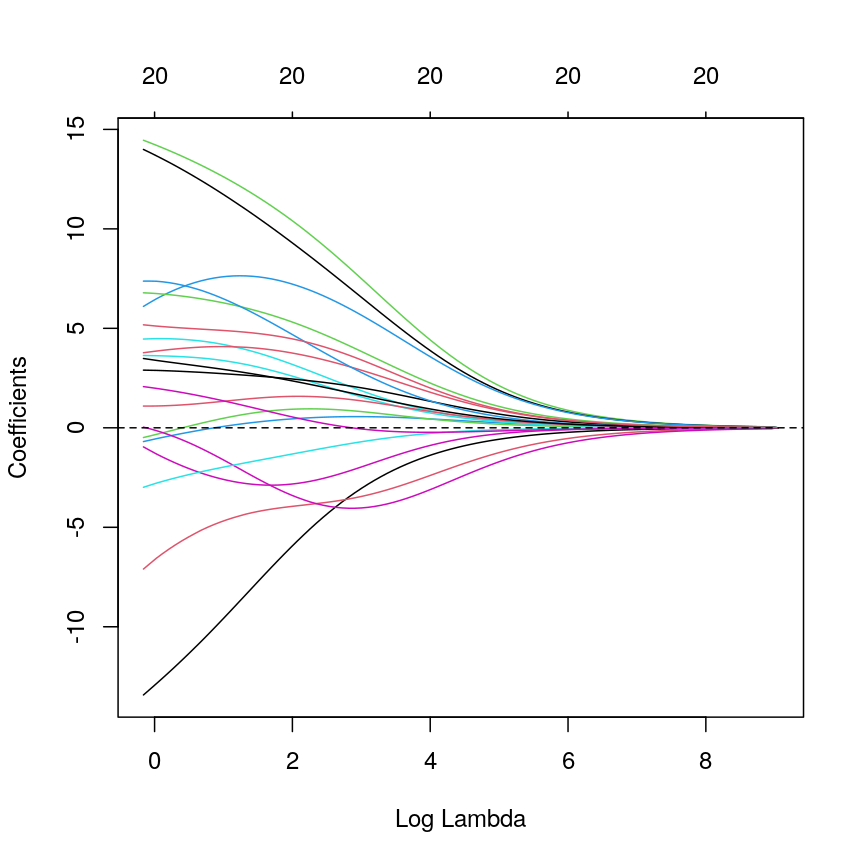

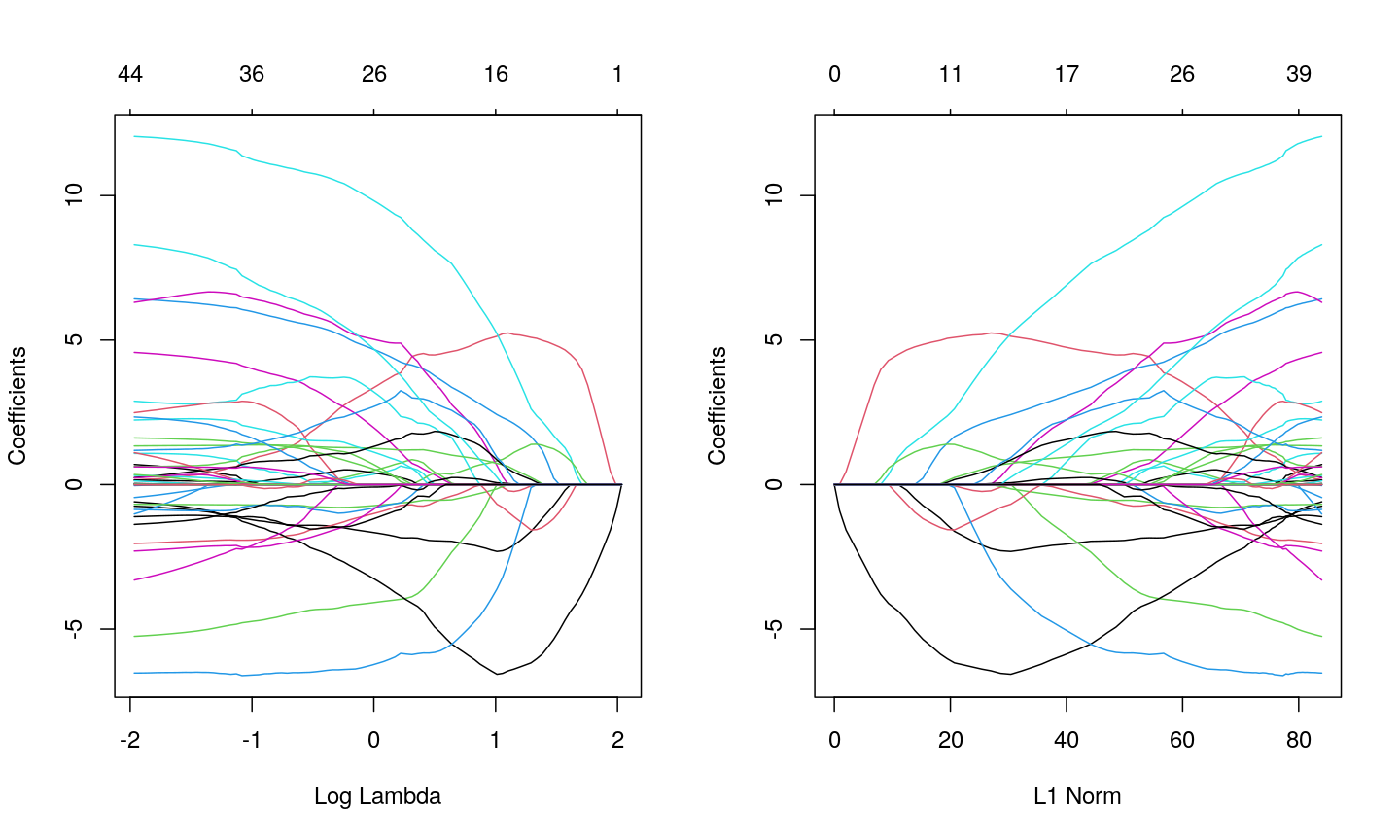

plot(ridge_fit, xvar = "lambda")

abline(h = 0, lty = "dashed")

A line plot of coefficient estimates against log lambda for a ridge regression model.

This plot shows how the estimated coefficients for each CpG site change as we increase the penalty, $\lambda$. That is, as we decrease the size of the region that solutions can fall into, the values of the coefficients that we get back tend to decrease. In this case, coefficients tend towards zero but generally don’t reach it until the penalty gets very large. We can see that initially, some parameter estimates are really, really large, and these tend to shrink fairly rapidly.

We can also notice that some parameters “flip signs”; that is, they start off positive and become negative as lambda grows. This is a sign of collinearity, or correlated predictors. As we reduce the importance of one feature, we can “make up for” the loss in accuracy from that one feature by adding a bit of weight to another feature that represents similar information.

Since we split the data into test and training data, we can prove that ridge regression predicts the test data better than the model with no regularisation. Let’s generate our predictions under the ridge regression model and calculate the mean squared error in the test set:

# Obtain a matrix of predictions from the ridge model,

# where each column corresponds to a different lambda value

pred_ridge <- predict(ridge_fit, newx = test_mat)

# Calculate MSE for every column of the prediction matrix against the vector of true ages

err_ridge <- apply(pred_ridge, 2, function(col) mse(test_age, col))

min_err_ridge <- min(err_ridge)

# Identify the lambda value that results in the lowest MSE (ie, the "best" lambda value)

which_min_err <- which.min(err_ridge)

pred_min_ridge <- pred_ridge[, which_min_err]

## Return errors

min_err_ridge

[1] 46.76802

This is much lower than the test error for the model without regularisation:

err_lm

[1] 223.3571

We can see where on the continuum of lambdas we’ve picked a model by plotting the coefficient paths again. In this case, we’ve picked a model with fairly modest coefficient shrinking.

chosen_lambda <- ridge_fit$lambda[which.min(err_ridge)]

plot(ridge_fit, xvar = "lambda")

abline(v = log(chosen_lambda), lty = "dashed")

A line plot of coefficient estimates against log lambda for a ridge regression model, showing the optimal value based on the minimal test error.

Challenge 4

- Which performs better, ridge or OLS?

- Plot predicted ages for each method against the true ages. How do the predictions look for both methods? Why might ridge be performing better?

Solution

Ridge regression performs significantly better on unseen data, despite being “worse” on the training data.

min_err_ridge[1] 46.76802err_lm[1] 223.3571The ridge ones are much less spread out with far fewer extreme predictions.

all <- c(pred_lm, test_age, pred_min_ridge) lims <- range(all) par(mfrow = 1:2) plot(test_age, pred_lm, xlim = lims, ylim = lims, pch = 19 ) abline(coef = 0:1, lty = "dashed") plot(test_age, pred_min_ridge, xlim = lims, ylim = lims, pch = 19 ) abline(coef = 0:1, lty = "dashed")

Two plots showing OLS predictions (left) and ridge regression predictions (right) of age (y) against true age (x).

LASSO regression

LASSO is another type of regularisation. In this case we use the $L^1$ norm, or the sum of the absolute values of the coefficients.

\[\left\lVert \beta \right\lVert_1 = \sum_{j=1}^p |\beta_j|\]This tends to produce sparse models; that is to say, it tends to remove features from the model that aren’t necessary to produce accurate predictions. This is because the region we’re restricting the coefficients to has sharp edges. So, when we increase the penalty (reduce the norm), it’s more likely that the best solution that falls in this region will be at the corner of this diagonal (i.e., one or more coefficient is exactly zero).

Illustrative example demonstrated how regression coefficients are inferred under a linear model framework, with (blue line) and without (red line) regularisation. A LASSO penalty is used in this example.

Challenge 5

- Use

glmnet()to fit a LASSO model (hint: setalpha = 1).- Plot the model object. Remember that for ridge regression, we set

xvar = "lambda". What if you don’t set this? What’s the relationship between the two plots?- How do the coefficient paths differ to the ridge case?

Solution

Fitting a LASSO model is very similar to a ridge model, we just need to change the

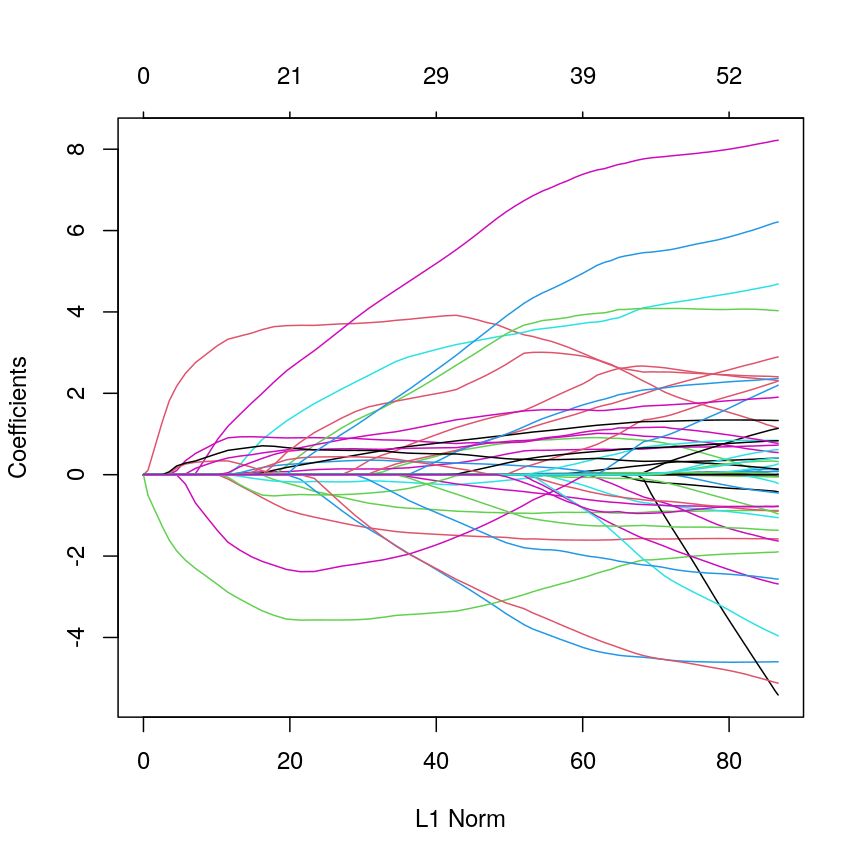

alphasetting.fit_lasso <- glmnet(x = methyl_mat, y = age, alpha = 1)When

xvar = "lambda", the x-axis represents increasing model sparsity from left to right, because increasing lambda increases the penalty added to the coefficients. When we instead plot the L1 norm on the x-axis, increasing L1 norm means that we are allowing our coefficients to take on increasingly large values.par(mfrow = c(1, 2)) plot(fit_lasso, xvar = "lambda") plot(fit_lasso)

Line plots showing coefficient values from a LASSO model against log lambda (left) and L1 norm (right).

When using LASSO, the paths tend to go to exactly zero much more as the penalty ($ \lambda $) increases. In the ridge case, the paths tend towards zero but less commonly reach exactly zero.

Cross-validation to find the best value of $\lambda$

Ideally, we want $\lambda$ to be large enough to reduce the complexity of our model, thus reducing the number of and correlations between the features, and improving generalisability. However, we don’t want the value of $\lambda$ to be so large that we lose a lot of the valuable information in the features.

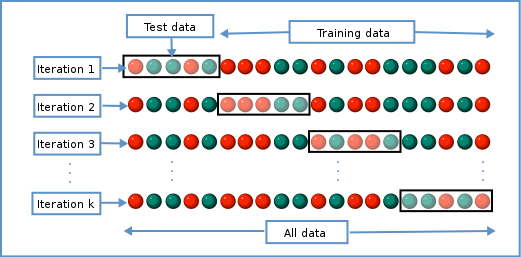

Various methods can be used to balance this trade-off and thus select the “best” value for $\lambda$. One method splits the data into $K$ chunks. We then use $K-1$ of these as the training set, and the remaining $1$ chunk as the test set. We can repeat this until we’ve rotated through all $K$ chunks, giving us a good estimate of how well each of the lambda values work in our data. This is called cross-validation, and doing this repeated test/train split gives us a better estimate of how generalisable our model is.

Schematic representiation of a $K$-fold cross-validation procedure.

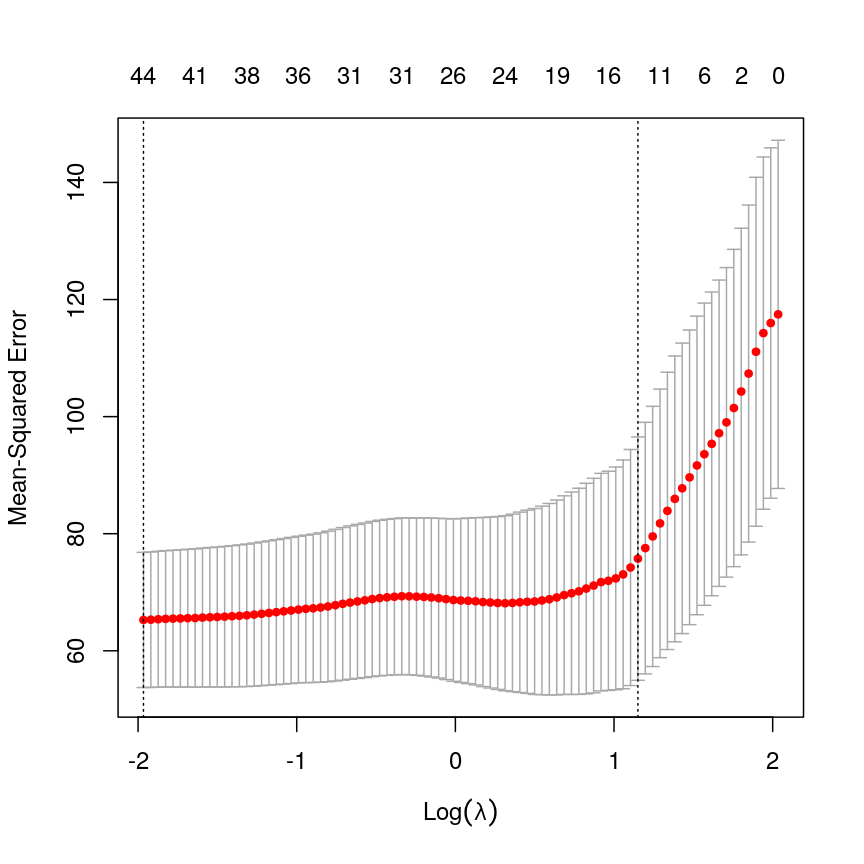

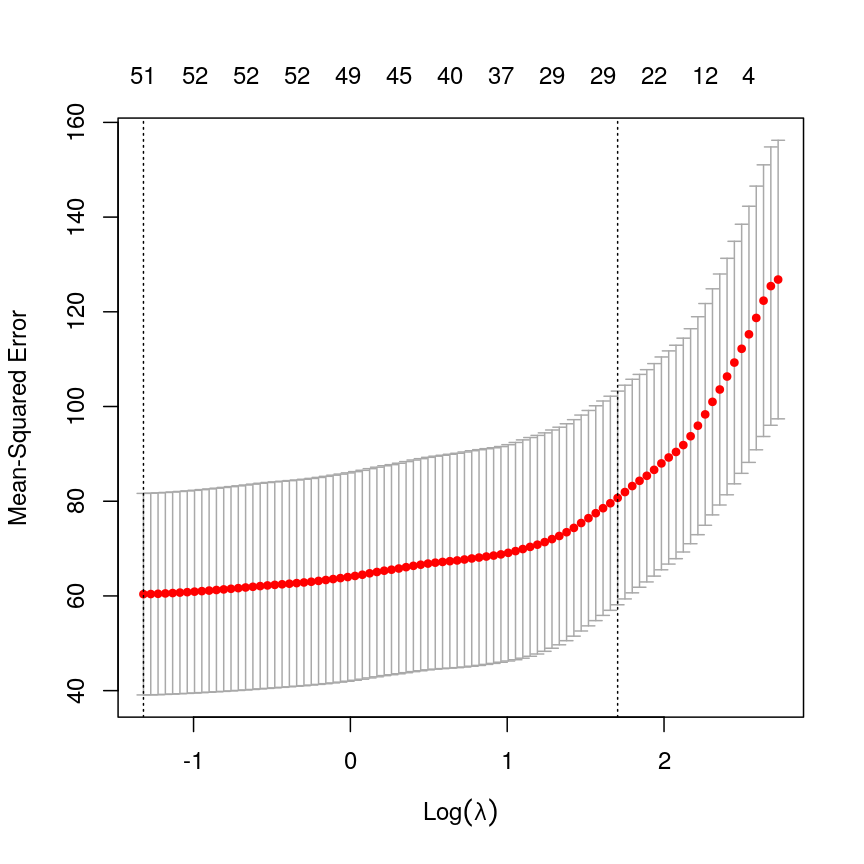

We can use this new idea to choose a lambda value by finding the lambda that minimises the error across each of the test and training splits. In R:

# fit lasso model with cross-validation across a range of lambda values

lasso <- cv.glmnet(methyl_mat, age, alpha = 1)

plot(lasso)

Cross-validated mean squared error for different values of lambda under a LASSO penalty.

# Extract the coefficients from the model with the lowest mean squared error from cross-validation

coefl <- coef(lasso, lasso$lambda.min)

# select only non-zero coefficients

selection <- which(coefl != 0)

# and convert to a normal matrix

selected_coefs <- as.matrix(coefl)[selection, 1]

selected_coefs

(Intercept) cg02388150 cg06493994 cg22449114 cg22736354

-8.4133296328 0.6966503392 0.1615535465 6.4255580409 12.0507794749

cg03330058 cg09809672 cg11299964 cg19761273 cg26162695

-0.0002362055 -0.7487594618 -2.0399663416 -5.2538055304 -0.4486970332

cg09502015 cg24771684 cg08446924 cg13215762 cg24549277

1.0787003366 4.5743800395 -0.5960137381 0.1481402638 0.6290915767

cg12304482 cg13131095 cg17962089 cg13842639 cg04080666

-1.0167896196 2.8860222552 6.3065284096 0.1590465147 2.4889065761

cg06147194 cg03669936 cg14230040 cg19848924 cg23964682

-0.6838637838 -0.0352696698 0.1280760909 -0.0006938337 1.3378854603

cg13578928 cg02745847 cg17410295 cg17459023 cg06223736

-0.8601170264 2.2346315955 -2.3008028295 0.0370389967 1.6158734083

cg06717750 cg20138604 cg12851161 cg20972027 cg23878422

2.3401693309 0.0084327521 -3.3033355652 0.2442751682 1.1059030593

cg16612298 cg03762081 cg14428146 cg16908369 cg16271524

0.0050053190 -6.5228858163 0.3167227488 0.2302773154 -1.3787104336

cg22071651 cg04262805 cg24969251 cg11233105 cg03156032

0.3480551279 1.1841804186 8.3024629942 0.6130598151 -1.1121959544

We can see that cross-validation has selected a value of $\lambda$ resulting in 44 features and the intercept.

Elastic nets: blending ridge regression and the LASSO

So far, we’ve used ridge regression (where alpha = 0) and LASSO regression,

(where alpha = 1). What if alpha is set to a value between zero and one?

Well, this actually lets us blend the properties of ridge and LASSO

regression. This allows us to have the nice properties of the LASSO, where

uninformative variables are dropped automatically, and the nice properties

of ridge regression, where our coefficient estimates are a bit more

conservative, and as a result our predictions are a bit better.

Formally, the objective function of elastic net regression is to optimise the following function:

\[\left(\sum_{i=1}^N y_i - x'_i\beta\right) + \lambda \left( \alpha \left\lVert \beta \right\lVert_1 + (1-\alpha) \left\lVert \beta \right\lVert_2 \right)\]You can see that if alpha = 1, then the L1 norm term is multiplied by one,

and the L2 norm is multiplied by zero. This means we have pure LASSO regression.

Conversely, if alpha = 0, the L2 norm term is multiplied by one, and the L1

norm is multiplied by zero, meaning we have pure ridge regression. Anything

in between gives us something in between.

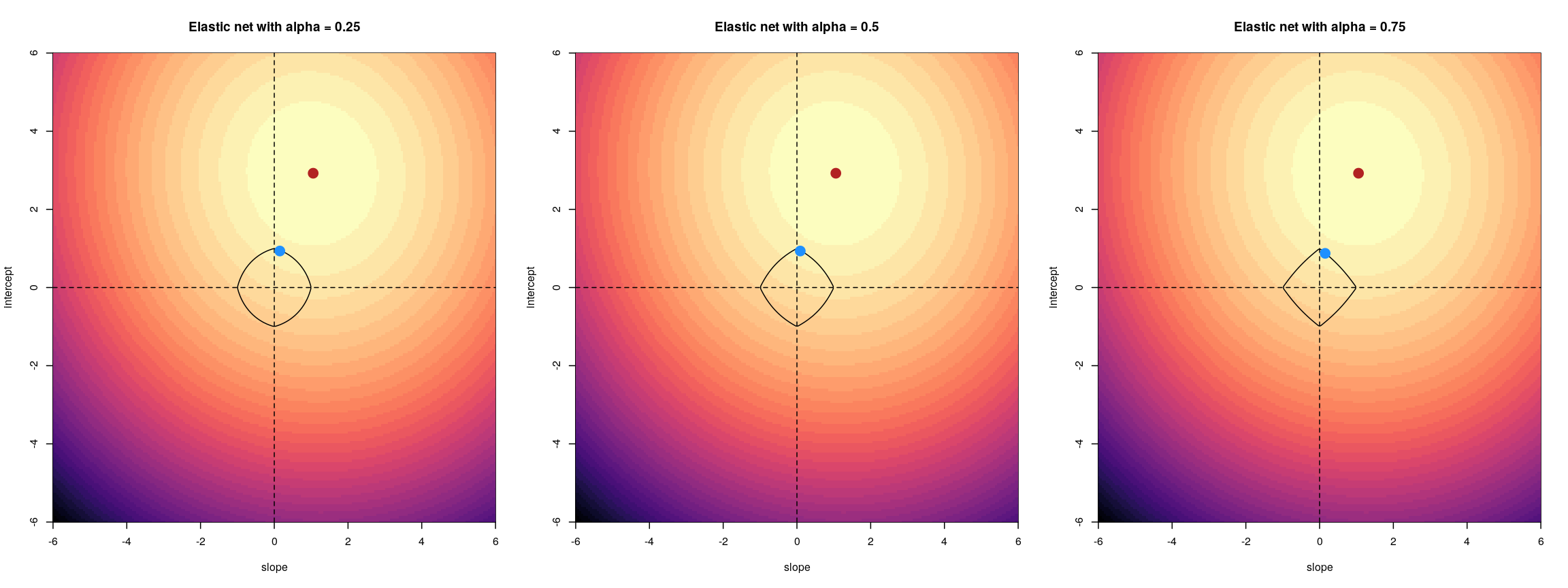

The contour plots we looked at previously to visualise what this penalty looks

like for different values of alpha.

For an elastic net, the panels show the effect of the regularisation across different values of alpha

Challenge 6

- Fit an elastic net model (hint: alpha = 0.5) without cross-validation and plot the model object.

- Fit an elastic net model with cross-validation and plot the error. Compare with LASSO.

- Select the lambda within one standard error of the minimum cross-validation error (hint:

lambda.1se). Compare the coefficients with the LASSO model.- Discuss: how could we pick an

alphain the range (0, 1)? Could we justify choosing one a priori?Solution

Fitting an elastic net model is just like fitting a LASSO model. You can see that coefficients tend to go exactly to zero, but the paths are a bit less extreme than with pure LASSO; similar to ridge.

elastic <- glmnet(methyl_mat[, -1], age, alpha = 0.5) plot(elastic)

Line plot showing coefficient values from an elastic net model against L1 norm.

The process of model selection is similar for elastic net models as for LASSO models.

elastic_cv <- cv.glmnet(methyl_mat[, -1], age, alpha = 0.5) plot(elastic_cv)

A plot depicting mean squared error (MSE) against discrete values of lambda, with red points showing the average mean squared error and grey error bars showing the 1 standard error interval around them. The MSE rises as log lambda increases, indicating a larger prediction error. Two dashed lines indicate the lambda value corresponding to the lowest overall MSE value and the lambda value corresponding to the lambda value with MSE with one standard error of the minimum.

You can see that the coefficients from these two methods are broadly similar, but the elastic net coefficients are a bit more conservative. Further, more coefficients are exactly zero in the LASSO model.

coefe <- coef(elastic_cv, elastic_cv$lambda.1se) sum(coefe[, 1] == 0)[1] 4973sum(coefl[, 1] == 0)[1] 4956plot( coefl[, 1], coefe[, 1], pch = 16, xlab = "LASSO coefficients", ylab = "Elastic net coefficients" )Error in xy.coords(x, y, xlabel, ylabel, log): 'x' and 'y' lengths differabline(0:1, lty = "dashed")Error in int_abline(a = a, b = b, h = h, v = v, untf = untf, ...): plot.new has not been called yetYou could pick an arbitrary value of

alpha, because arguably pure ridge regression or pure LASSO regression are also arbitrary model choices. To be rigorous and to get the best-performing model and the best inference about predictors, it’s usually best to find the best combination ofalphaandlambdausing a grid search approach in cross-validation. However, this can be very computationally demanding.

The bias-variance tradeoff

When we make predictions in statistics, there are two sources of error that primarily influence the (in)accuracy of our predictions. these are bias and variance.

The total expected error in our predictions is given by the following equation:

\[E(y - \hat{y}) = \text{Bias}^2 + \text{Variance} + \sigma^2\]Here, $\sigma^2$ represents the irreducible error, that we can never overcome. Bias results from erroneous assumptions in the model used for predictions. Fundamentally, bias means that our model is mis-specified in some way, and fails to capture some components of the data-generating process (which is true of all models). If we have failed to account for a confounding factor that leads to very inaccurate predictions in a subgroup of our population, then our model has high bias.

Variance results from sensitivity to particular properties of the input data. For example, if a tiny change to the input data would result in a huge change to our predictions, then our model has high variance.

Linear regression is an unbiased model under certain conditions. In fact, the Gauss-Markov theorem shows that under the right conditions, OLS is the best possible type of unbiased linear model.

Introducing penalties to means that our model is no longer unbiased, meaning that the coefficients estimated from our data will systematically deviate from the ground truth. Why would we do this? As we saw, the total error is a function of bias and variance. By accepting a small amount of bias, it’s possible to achieve huge reductions in the total expected error.

This bias-variance tradeoff is also why people often favour elastic net regression over pure LASSO regression.

Other types of outcomes

You may have noticed that

glmnetis written asglm, notlm. This means we can actually model a variety of different outcomes using this regularisation approach. For example, we can model binary variables using logistic regression, as shown below. The type of outcome can be specified using thefamilyargument, which specifies the family of the outcome variable.In fact,

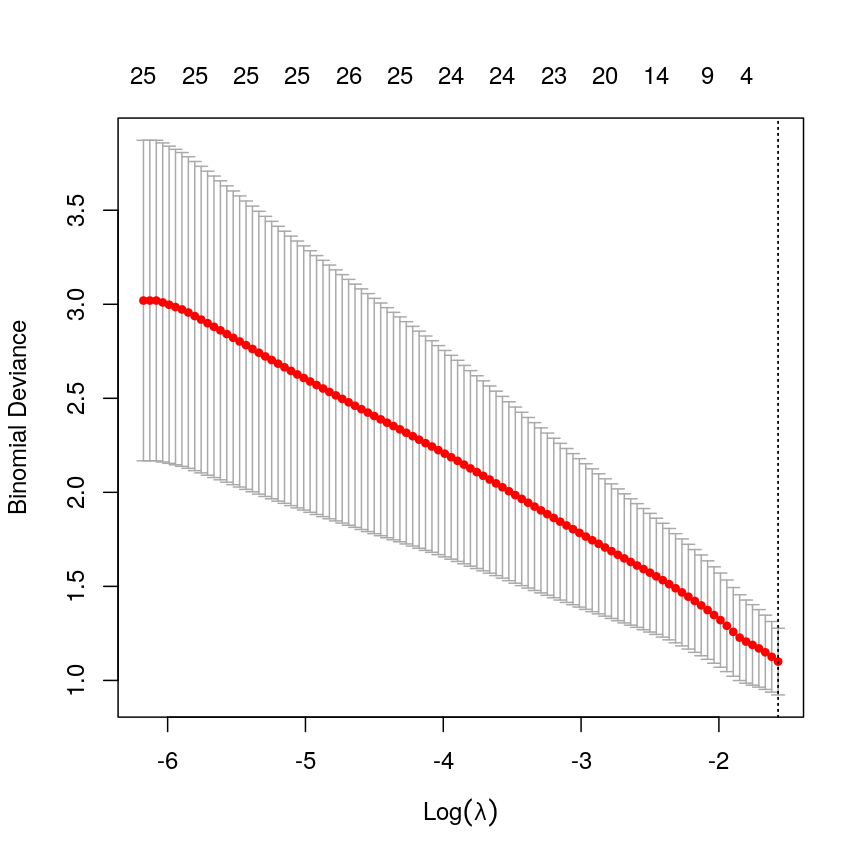

glmnetis somewhat cheeky as it also allows you to model survival using Cox proportional hazards models, which aren’t GLMs, strictly speaking.For example, in the current dataset we can model smoking status as a binary variable in logistic regression by setting

family = "binomial".The package documentation explains this in more detail.

smoking <- as.numeric(factor(methylation$smoker)) - 1 # binary outcome table(smoking)smoking 0 1 30 7fit <- cv.glmnet(x = methyl_mat, nfolds = 5, y = smoking, family = "binomial")Warning in lognet(xd, is.sparse, ix, jx, y, weights, offset, alpha, nobs, : one multinomial or binomial class has fewer than 8 observations; dangerous ground Warning in lognet(xd, is.sparse, ix, jx, y, weights, offset, alpha, nobs, : one multinomial or binomial class has fewer than 8 observations; dangerous ground Warning in lognet(xd, is.sparse, ix, jx, y, weights, offset, alpha, nobs, : one multinomial or binomial class has fewer than 8 observations; dangerous ground Warning in lognet(xd, is.sparse, ix, jx, y, weights, offset, alpha, nobs, : one multinomial or binomial class has fewer than 8 observations; dangerous ground Warning in lognet(xd, is.sparse, ix, jx, y, weights, offset, alpha, nobs, : one multinomial or binomial class has fewer than 8 observations; dangerous ground Warning in lognet(xd, is.sparse, ix, jx, y, weights, offset, alpha, nobs, : one multinomial or binomial class has fewer than 8 observations; dangerous groundcoef <- coef(fit, s = fit$lambda.min) coef <- as.matrix(coef) coef[which(coef != 0), 1][1] -1.455287plot(fit)

A plot depicting binomial deviance against discrete values of lambda, with red points showing the average mean squared error and grey error bars showing the 1 standard error interval around them. The MSE decreases as log lambda increases, indicating a smaller prediction error. Two dashed lines indicate the lambda value corresponding to the lowest overall MSE value and the lambda value corresponding to the lambda value with MSE with one standard error of the minimum, with both being exactly on the right side of the plot, indicating an intercept-only model.

In this case, the results aren’t very interesting! We select an intercept-only model. However, as highlighted by the warnings above, we should not trust this result too much as the data was too small to obtain reliable results! We only included it here to provide the code that could be used to perform penalised regression for binary outcomes (i.e. penalised logistic regression).

tidymodels

A lot of the packages for fitting predictive models like regularised regression have different user interfaces. To do predictive modelling, it’s important to consider things like choosing a good performance metric and how to run normalisation. It’s also useful to compare different model “engines”.

To this end, the

tidymodelsR framework exists. We’re not doing a course on advanced topics in predictive modelling so we are not covering this framework in detail. However, the code below would be useful to perform repeated cross-validation. More information abouttidymodels, including installation instructions, can be found here.library("tidymodels") all_data <- as.data.frame(cbind(age = age, methyl_mat)) split_data <- initial_split(all_data) norm_recipe <- recipe(training(split_data)) %>% ## everything other than age is a predictor update_role(everything(), new_role = "predictor") %>% update_role(age, new_role = "outcome") %>% ## center and scale all the predictors step_center(all_predictors()) %>% step_scale(all_predictors()) ## set the "engine" to be a linear model with tunable alpha and lambda glmnet_model <- linear_reg(penalty = tune(), mixture = tune()) %>% set_engine("glmnet") ## define a workflow, with normalisation recipe into glmnet engine workflow <- workflow() %>% add_recipe(norm_recipe) %>% add_model(glmnet_model) ## 5-fold cross-validation repeated 5 times folds <- vfold_cv(training(split_data), v = 5, repeats = 5) ## define a grid of lambda and alpha parameters to search glmn_set <- parameters( penalty(range = c(-5, 1), trans = log10_trans()), mixture() ) glmn_grid <- grid_regular(glmn_set) ctrl <- control_grid(save_pred = TRUE, verbose = TRUE) ## use the metric "rmse" (root mean squared error) to grid search for the ## best model results <- workflow %>% tune_grid( resamples = folds, metrics = metric_set(rmse), control = ctrl ) ## select the best model based on RMSE best_mod <- results %>% select_best("rmse") best_mod ## finalise the workflow and fit it with all of the training data final_workflow <- finalize_workflow(workflow, best_mod) final_workflow final_model <- final_workflow %>% fit(data = training(split_data)) ## plot predicted age against true age for test data plot( testing(split_data)$age, predict(final_model, new_data = testing(split_data))$.pred, xlab = "True age", ylab = "Predicted age", pch = 16, log = "xy" ) abline(0:1, lty = "dashed")

Further reading

- An introduction to statistical learning.

- Elements of statistical learning.

- glmnet vignette.

- tidymodels.

Footnotes

-

Model selection including $R^2$, AIC and BIC are covered in the additional feature selection for regression episode of this course. ↩

Key Points

Regularisation is a way to fit a model, get better estimates of effect sizes, and perform variable selection simultaneously.

Test and training splits, or cross-validation, are a useful way to select models or hyperparameters.

Regularisation can give us a more predictive set of variables, and by restricting the magnitude of coefficients, can give us a better (and more stable) estimate of our outcome.

Regularisation is often very fast! Compared to other methods for variable selection, it is very efficient. This makes it easier to practice rigorous variable selection.