Exploring high dimensional data

Overview

Teaching: 20 min

Exercises: 2 minQuestions

What is a high dimensional dataset?

Objectives

Define a dimension, index, and observation

Define, identify, and give examples of high dimensional datasets

Summarize the dimensionality of a given dataset

Introduction - what is high dimensional data?

What is data?

da·ta

/ˈdadə, ˈdādə/ noun “the quantities, characters, or symbols on which operations are performed by a computer”

—Oxford Languages

(how is data formatted? structured, semi-structured, unstructured: flat file, json, raw text)

There is a conversion to numerical representation happening here

A rectangular dataset: Original data set not rectangular, might require conversion that produces high dimensional rectangular data set.

We’re discussing structured, rectangular data only today.

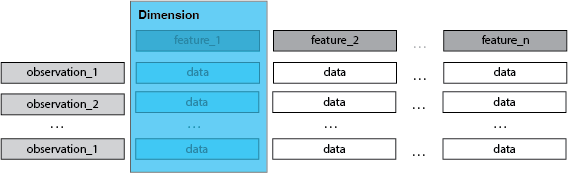

What is a dimension?

di·men·sion

/dəˈmen(t)SH(ə)n, dīˈmen(t)SH(ə)n/

noun noun: dimension; plural noun: dimensions

- a measurable extent of some kind, such as length, breadth, depth, or height.

- an aspect or feature of a situation, problem, or thing.

—Oxford Languages

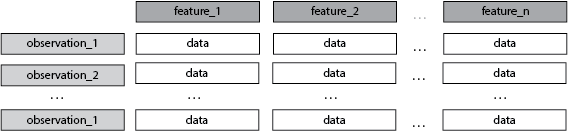

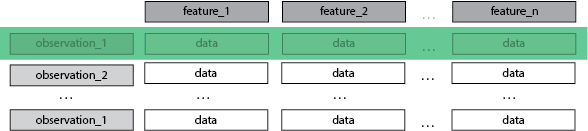

A Tabular/Rectangular Data Context

Each row is an observation, is a sample.

Each column is a feature, is a dimension.

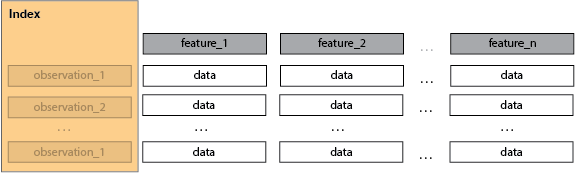

The index is not a dimension.

A Dataset

- Some number of observations > 1

- every feature of an observation is a dimension

- the number of observations i.e. the index, is not a dimension

Examples of datasets with increasing dimensionality

1 D

- likert scale question (index: respondent_id, question value (-3 to 3)

2 D

- scatter plot (x, y)

- two question survey (index: respondent_id, q1 answer, q2 answer)

- data from temperature logger: (index: logged_value_id, time, value)

3 D

- surface (x, y, z)

- scatter plot with variable as size per point (x, y, size)

- 2d black and white image (x, y, pixel_value)

- moves log from a game of ‘battleship’ (index: move number, x-coord, y-coord, hit/miss)

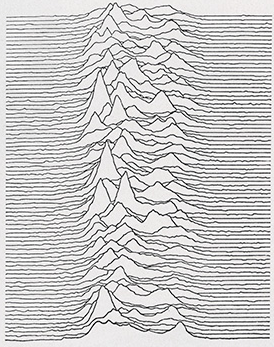

- consecutive pulses of CP 1919 (time, x, y)

4 D

- surface plus coloration, (x, y, z, color_label)

- surface change over time (x, y, z, time)

30 D

- Brain connectivity analysis of 30 regions

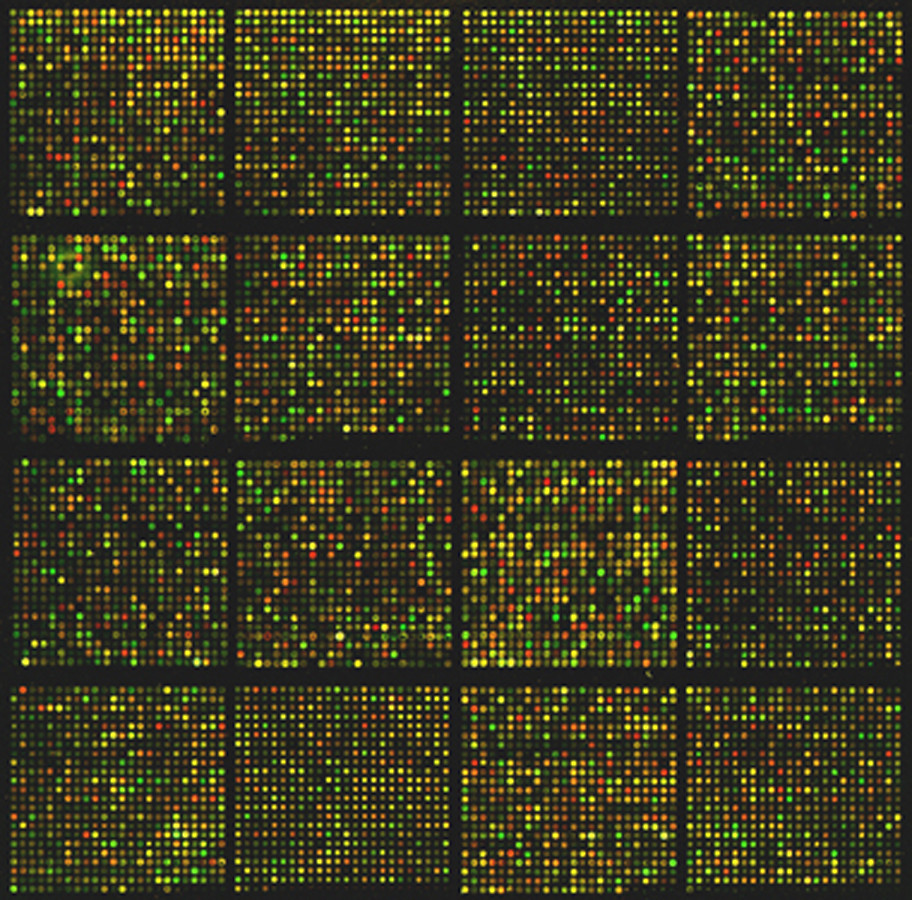

20, 000 D

human gene expression e.g.

Exercise - Battleship moves:

discussion point is this 3d or 4d?

is the move number a dimension or an index?

move_id column (A-J) row (1-10) hit 0 A 1 False 1 J 10 True 2 C 7 False n … … Solution

3d: move_id is an index!

- order sequence matters but not the specific value of the move number

4d: move_id is a dimension!

- odd or even tells you which player is making which move

- order sequence is important, but when a specific moves get made might matter - what if you wanted to analyze moves as a function of game length?

There is always an index

- move_id is an index

- that doesn’t mean there is no information there

- you can perform some feature engineering with move_id

- this would up the dimensionality of the inital 3d dataset perhaps adding two more dimensions:

- player

- player’s move number

Exercise - Film:

consider a short, black and white, silent film, in 4K. It has the following properties:

- 1 minute long

- 25 frames per second

- 4K resolution i.e. 4096 × 2160.

- standard color depth 24 bits/pixel

Think of this film as a dataset, How many observations might there be?

Solution:

60 seconds x 25 frames per second = 1500 frames or ‘observations’. Is there another way to think about this?

Exercise: How many dimensions are there per observation?

Solution:

There are three dimensions per observation:

- pixel row (0-2159)

- pixel col (0-4095)

- pixel grey value (0-255)

Exercise: How many dimensions would there be if the film was longer, or shorter?

Solution:

- The number of dimensions would NOT change.

- There would simply be a greater or fewer number of ‘observations’

Exercise: How many dimensions would there be if the film was in color?

Solution:

4 dimensions.

There is an extra dimension per observation now.

- channel value (red, green, blue)

- pixel row (0-2159)

- pixel col (0-4095)

- pixel intensity (0-255)

Exercise: Titanic dataset

Look at the kaggle Titantic Dataset.

passenger_id pclass name sex age sibsp parch ticket fare cabin embarked boat body home.dest survived 1216 3 Smyth, Miss. Julia female 0 0 335432 7.7333 Q 13 1 699 3 Cacic, Mr. Luka male 38.0 0 0 315089 8.6625 S Croatia 0 1267 3 Van Impe, Mrs. Jean Baptiste (Rosalie Paula Govaert) female 30.0 1 1 345773 24.15 S 0 449 2 Hocking, Mrs. Elizabeth (Eliza Needs) female 54.0 1 3 29105 23.0 S 4 Cornwall / Akron, OH 1 576 2 Veal, Mr. James male 40.0 0 0 28221 13.0 S Barre, Co Washington, VT 0 What column is the index?

Solution:

PassengerId

Exercise: What columns are the dimensions?

Solution:

- pclass

- name

- sex

- age

- sibsp

- parch

- ticket

- fare

- cabin

- embarked

- survived

Exercise: how many dimensions are there?

Solution:

11

Exercise: Imagine building a model to predict survival on the titantic

- would you use every dimension?

- what makes a dimension useful?

- could you remove some dimensions?

- could you combine some dimensions?

- how would you combine those dimensions?

- do you have fewer dimensions after combining?

- do you have less information after combining?

Solution:

- No, some variables are poor predictors and can be ignored

- If it is (anti-)correlated with survival (in some context) i.e. has information.

- Yes any mostly null columns are not useful (add no information), any highly correlated columns also (no additional information)

- Yes

- Maybe add SibSp and Parch into one ‘family count’.

- Yes.

- Yes, but more data than if columns had been excluded.

High-Dimensional Data

What is high-dimensional data? Unfortunately, there isn’t a precise definition. Often, when people use the term, they are referring to specific problems and headaches that arise when working with data that has many (typically dozens or more) features (a.k.a. dimensions). These problems are generally referred to as the “curse of dimensionality”.

Curse of Dimensionality

The “curse of dimensionality” refers to the challenges that arise when dealing with data in high-dimensional spaces. These challenges include:

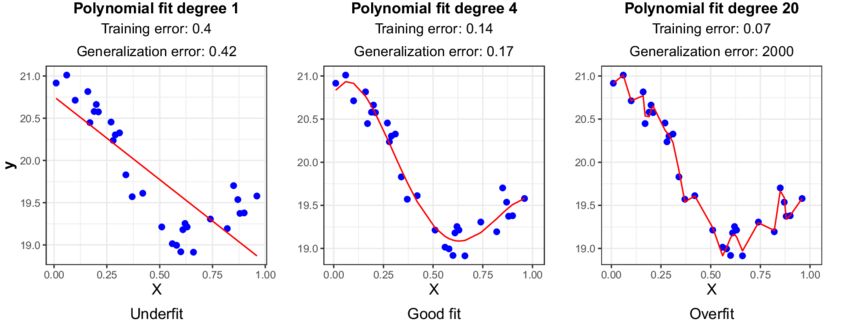

- Overfitting in Models: Machine learning models are prone to overfitting when the number of features approaches or exceeds the number of observations in the data. In this context, what is considered “high-dimensional is relative to the number of observations in your data.

- Increased Computational Complexity: As dimensions increase, so do compute needs both in terms of memory and processing power. This can make the analysis more difficult.

- Visualization Challenges: Visualizing data with many features becomes challenging, as humans can easily comprehend only up to three dimensions.

- Increased Sparsity: As dimensions increase, the volume of the space grows exponentially, making data points more spread out and less dense.

- Reduced Meaningfulness of Distance: As dimensions increase, the concept of distance between data points becomes less intuitive and less useful for distinguishing between different points.

Throughout this workshop, we’ll see how these challenges, or “curses,” apply to our research goals and explore strategies to address them.

Key Points

data can be anything - as long as you can represent it in a computer

A dimension is a feature in a dataset - i.e. a column, but NOT an index.

an index is not a dimension

The Ames housing dataset

Overview

Teaching: 45 min

Exercises: 2 minQuestions

Here we introduce the data we’ll be analyzing

Objectives

Intro to Ames Housing Dataset

Throughout this workshop, we will explore how to efficiently detect patterns and extract insights from high-dimensional data. We will focus on a widely accessible dataset known as the Ames housing data. This dataset will serve as a foundational example, allowing us to grasp the challenges and opportunities presented by high-dimensional data analysis.

Load the dataset

Here we load the dataset from the sklearn library, and see a preview

from sklearn.datasets import fetch_openml

# load the dataset

housing = fetch_openml(name="house_prices", as_frame=True, parser='auto')

df = housing.data.copy(deep=True) # create new DataFrame copy of original dataset

df = df.astype({'Id': int}) # set data type of Id to int

df = df.set_index('Id') # set Id column to be the index of the DataFrame

df # evaluate result

| MSSubClass | MSZoning | LotFrontage | LotArea | Street | Alley | LotShape | LandContour | Utilities | LotConfig | ... | ScreenPorch | PoolArea | PoolQC | Fence | MiscFeature | MiscVal | MoSold | YrSold | SaleType | SaleCondition | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Id | |||||||||||||||||||||

| 1 | 60 | RL | 65.0 | 8450 | Pave | NaN | Reg | Lvl | AllPub | Inside | ... | 0 | 0 | NaN | NaN | NaN | 0 | 2 | 2008 | WD | Normal |

| 2 | 20 | RL | 80.0 | 9600 | Pave | NaN | Reg | Lvl | AllPub | FR2 | ... | 0 | 0 | NaN | NaN | NaN | 0 | 5 | 2007 | WD | Normal |

| 3 | 60 | RL | 68.0 | 11250 | Pave | NaN | IR1 | Lvl | AllPub | Inside | ... | 0 | 0 | NaN | NaN | NaN | 0 | 9 | 2008 | WD | Normal |

| 4 | 70 | RL | 60.0 | 9550 | Pave | NaN | IR1 | Lvl | AllPub | Corner | ... | 0 | 0 | NaN | NaN | NaN | 0 | 2 | 2006 | WD | Abnorml |

| 5 | 60 | RL | 84.0 | 14260 | Pave | NaN | IR1 | Lvl | AllPub | FR2 | ... | 0 | 0 | NaN | NaN | NaN | 0 | 12 | 2008 | WD | Normal |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 1456 | 60 | RL | 62.0 | 7917 | Pave | NaN | Reg | Lvl | AllPub | Inside | ... | 0 | 0 | NaN | NaN | NaN | 0 | 8 | 2007 | WD | Normal |

| 1457 | 20 | RL | 85.0 | 13175 | Pave | NaN | Reg | Lvl | AllPub | Inside | ... | 0 | 0 | NaN | MnPrv | NaN | 0 | 2 | 2010 | WD | Normal |

| 1458 | 70 | RL | 66.0 | 9042 | Pave | NaN | Reg | Lvl | AllPub | Inside | ... | 0 | 0 | NaN | GdPrv | Shed | 2500 | 5 | 2010 | WD | Normal |

| 1459 | 20 | RL | 68.0 | 9717 | Pave | NaN | Reg | Lvl | AllPub | Inside | ... | 0 | 0 | NaN | NaN | NaN | 0 | 4 | 2010 | WD | Normal |

| 1460 | 20 | RL | 75.0 | 9937 | Pave | NaN | Reg | Lvl | AllPub | Inside | ... | 0 | 0 | NaN | NaN | NaN | 0 | 6 | 2008 | WD | Normal |

1460 rows × 79 columns

print(df.columns.tolist())

['MSSubClass', 'MSZoning', 'LotFrontage', 'LotArea', 'Street', 'Alley', 'LotShape', 'LandContour', 'Utilities', 'LotConfig', 'LandSlope', 'Neighborhood', 'Condition1', 'Condition2', 'BldgType', 'HouseStyle', 'OverallQual', 'OverallCond', 'YearBuilt', 'YearRemodAdd', 'RoofStyle', 'RoofMatl', 'Exterior1st', 'Exterior2nd', 'MasVnrType', 'MasVnrArea', 'ExterQual', 'ExterCond', 'Foundation', 'BsmtQual', 'BsmtCond', 'BsmtExposure', 'BsmtFinType1', 'BsmtFinSF1', 'BsmtFinType2', 'BsmtFinSF2', 'BsmtUnfSF', 'TotalBsmtSF', 'Heating', 'HeatingQC', 'CentralAir', 'Electrical', '1stFlrSF', '2ndFlrSF', 'LowQualFinSF', 'GrLivArea', 'BsmtFullBath', 'BsmtHalfBath', 'FullBath', 'HalfBath', 'BedroomAbvGr', 'KitchenAbvGr', 'KitchenQual', 'TotRmsAbvGrd', 'Functional', 'Fireplaces', 'FireplaceQu', 'GarageType', 'GarageYrBlt', 'GarageFinish', 'GarageCars', 'GarageArea', 'GarageQual', 'GarageCond', 'PavedDrive', 'WoodDeckSF', 'OpenPorchSF', 'EnclosedPorch', '3SsnPorch', 'ScreenPorch', 'PoolArea', 'PoolQC', 'Fence', 'MiscFeature', 'MiscVal', 'MoSold', 'YrSold', 'SaleType', 'SaleCondition']

Dataset Preview Exercises

How many features are there?

Solution

79

EXERCISE: How many observations are there?

Solution

1460

EXERCISE: What are all the feature names?

Solution

print(df.columns.tolist())['MSSubClass', 'MSZoning', 'LotFrontage', 'LotArea', 'Street', 'Alley', 'LotShape', 'LandContour', 'Utilities', 'LotConfig', 'LandSlope', 'Neighborhood', 'Condition1', 'Condition2', 'BldgType', 'HouseStyle', 'OverallQual', 'OverallCond', 'YearBuilt', 'YearRemodAdd', 'RoofStyle', 'RoofMatl', 'Exterior1st', 'Exterior2nd', 'MasVnrType', 'MasVnrArea', 'ExterQual', 'ExterCond', 'Foundation', 'BsmtQual', 'BsmtCond', 'BsmtExposure', 'BsmtFinType1', 'BsmtFinSF1', 'BsmtFinType2', 'BsmtFinSF2', 'BsmtUnfSF', 'TotalBsmtSF', 'Heating', 'HeatingQC', 'CentralAir', 'Electrical', '1stFlrSF', '2ndFlrSF', 'LowQualFinSF', 'GrLivArea', 'BsmtFullBath', 'BsmtHalfBath', 'FullBath', 'HalfBath', 'BedroomAbvGr', 'KitchenAbvGr', 'KitchenQual', 'TotRmsAbvGrd', 'Functional', 'Fireplaces', 'FireplaceQu', 'GarageType', 'GarageYrBlt', 'GarageFinish', 'GarageCars', 'GarageArea', 'GarageQual', 'GarageCond', 'PavedDrive', 'WoodDeckSF', 'OpenPorchSF', 'EnclosedPorch', '3SsnPorch', 'ScreenPorch', 'PoolArea', 'PoolQC', 'Fence', 'MiscFeature', 'MiscVal', 'MoSold', 'YrSold', 'SaleType', 'SaleCondition']EXERCISE_END

How do I find out what these features mean?

Read the Data Dictionary

from IPython.display import display, Pretty # the housing object we created in step one above contains a Data Dictionary for the Dataset display(Pretty(housing.DESCR))Ask a home buyer to describe their dream house, and they probably won’t begin with the height of the basement ceiling or the proximity to an east-west railroad. But this playground competition’s dataset proves that much more influences price negotiations than the number of bedrooms or a white-picket fence.

With 79 explanatory variables describing (almost) every aspect of residential homes in Ames, Iowa, this competition challenges you to predict the final price of each home.

MSSubClass: Identifies the type of dwelling involved in the sale.

20 1-STORY 1946 & NEWER ALL STYLES 30 1-STORY 1945 & OLDER 40 1-STORY W/FINISHED ATTIC ALL AGES 45 1-1/2 STORY - UNFINISHED ALL AGES 50 1-1/2 STORY FINISHED ALL AGES 60 2-STORY 1946 & NEWER 70 2-STORY 1945 & OLDER 75 2-1/2 STORY ALL AGES 80 SPLIT OR MULTI-LEVEL 85 SPLIT FOYER 90 DUPLEX - ALL STYLES AND AGES 120 1-STORY PUD (Planned Unit Development) - 1946 & NEWER 150 1-1/2 STORY PUD - ALL AGES 160 2-STORY PUD - 1946 & NEWER 180 PUD - MULTILEVEL - INCL SPLIT LEV/FOYER 190 2 FAMILY CONVERSION - ALL STYLES AND AGES

MSZoning: Identifies the general zoning classification of the sale.

A Agriculture C Commercial FV Floating Village Residential I Industrial RH Residential High Density RL Residential Low Density RP Residential Low Density Park RM Residential Medium Density

LotFrontage: Linear feet of street connected to property

LotArea: Lot size in square feet

Street: Type of road access to property

Grvl Gravel Pave Paved

Alley: Type of alley access to property

Grvl Gravel Pave Paved NA No alley access

LotShape: General shape of property

Reg Regular IR1 Slightly irregular IR2 Moderately Irregular IR3 Irregular

LandContour: Flatness of the property

Lvl Near Flat/Level Bnk Banked - Quick and significant rise from street grade to building HLS Hillside - Significant slope from side to side Low Depression

Utilities: Type of utilities available

AllPub All public Utilities (E,G,W,& S) NoSewr Electricity, Gas, and Water (Septic Tank) NoSeWa Electricity and Gas Only ELO Electricity only

LotConfig: Lot configuration

Inside Inside lot Corner Corner lot CulDSac Cul-de-sac FR2 Frontage on 2 sides of property FR3 Frontage on 3 sides of property

LandSlope: Slope of property

Gtl Gentle slope Mod Moderate Slope Sev Severe Slope

Neighborhood: Physical locations within Ames city limits

Blmngtn Bloomington Heights Blueste Bluestem BrDale Briardale BrkSide Brookside ClearCr Clear Creek CollgCr College Creek Crawfor Crawford Edwards Edwards Gilbert Gilbert IDOTRR Iowa DOT and Rail Road MeadowV Meadow Village Mitchel Mitchell Names North Ames NoRidge Northridge NPkVill Northpark Villa NridgHt Northridge Heights NWAmes Northwest Ames OldTown Old Town SWISU South & West of Iowa State University Sawyer Sawyer SawyerW Sawyer West Somerst Somerset StoneBr Stone Brook Timber Timberland Veenker Veenker

Condition1: Proximity to various conditions

Artery Adjacent to arterial street Feedr Adjacent to feeder street Norm Normal RRNn Within 200’ of North-South Railroad RRAn Adjacent to North-South Railroad PosN Near positive off-site feature–park, greenbelt, etc. PosA Adjacent to postive off-site feature RRNe Within 200’ of East-West Railroad RRAe Adjacent to East-West Railroad

Condition2: Proximity to various conditions (if more than one is present)

Artery Adjacent to arterial street Feedr Adjacent to feeder street Norm Normal RRNn Within 200’ of North-South Railroad RRAn Adjacent to North-South Railroad PosN Near positive off-site feature–park, greenbelt, etc. PosA Adjacent to postive off-site feature RRNe Within 200’ of East-West Railroad RRAe Adjacent to East-West Railroad

BldgType: Type of dwelling

1Fam Single-family Detached 2FmCon Two-family Conversion; originally built as one-family dwelling Duplx Duplex TwnhsE Townhouse End Unit TwnhsI Townhouse Inside Unit

HouseStyle: Style of dwelling

1Story One story 1.5Fin One and one-half story: 2nd level finished 1.5Unf One and one-half story: 2nd level unfinished 2Story Two story 2.5Fin Two and one-half story: 2nd level finished 2.5Unf Two and one-half story: 2nd level unfinished SFoyer Split Foyer SLvl Split Level

OverallQual: Rates the overall material and finish of the house

10 Very Excellent 9 Excellent 8 Very Good 7 Good 6 Above Average 5 Average 4 Below Average 3 Fair 2 Poor 1 Very Poor

OverallCond: Rates the overall condition of the house

10 Very Excellent 9 Excellent 8 Very Good 7 Good 6 Above Average 5 Average 4 Below Average 3 Fair 2 Poor 1 Very Poor

YearBuilt: Original construction date

YearRemodAdd: Remodel date (same as construction date if no remodeling or additions)

RoofStyle: Type of roof

Flat Flat Gable Gable Gambrel Gabrel (Barn) Hip Hip Mansard Mansard Shed Shed

RoofMatl: Roof material

ClyTile Clay or Tile CompShg Standard (Composite) Shingle Membran Membrane Metal Metal Roll Roll Tar&Grv Gravel & Tar WdShake Wood Shakes WdShngl Wood Shingles

Exterior1st: Exterior covering on house

AsbShng Asbestos Shingles AsphShn Asphalt Shingles BrkComm Brick Common BrkFace Brick Face CBlock Cinder Block CemntBd Cement Board HdBoard Hard Board ImStucc Imitation Stucco MetalSd Metal Siding Other Other Plywood Plywood PreCast PreCast Stone Stone Stucco Stucco VinylSd Vinyl Siding Wd Sdng Wood Siding WdShing Wood Shingles

Exterior2nd: Exterior covering on house (if more than one material)

AsbShng Asbestos Shingles AsphShn Asphalt Shingles BrkComm Brick Common BrkFace Brick Face CBlock Cinder Block CemntBd Cement Board HdBoard Hard Board ImStucc Imitation Stucco MetalSd Metal Siding Other Other Plywood Plywood PreCast PreCast Stone Stone Stucco Stucco VinylSd Vinyl Siding Wd Sdng Wood Siding WdShing Wood Shingles

MasVnrType: Masonry veneer type

BrkCmn Brick Common BrkFace Brick Face CBlock Cinder Block None None Stone Stone

MasVnrArea: Masonry veneer area in square feet

ExterQual: Evaluates the quality of the material on the exterior

Ex Excellent Gd Good TA Average/Typical Fa Fair Po Poor

ExterCond: Evaluates the present condition of the material on the exterior

Ex Excellent Gd Good TA Average/Typical Fa Fair Po Poor

Foundation: Type of foundation

BrkTil Brick & Tile CBlock Cinder Block PConc Poured Contrete Slab Slab Stone Stone Wood Wood

BsmtQual: Evaluates the height of the basement

Ex Excellent (100+ inches) Gd Good (90-99 inches) TA Typical (80-89 inches) Fa Fair (70-79 inches) Po Poor (<70 inches NA No Basement

BsmtCond: Evaluates the general condition of the basement

Ex Excellent Gd Good TA Typical - slight dampness allowed Fa Fair - dampness or some cracking or settling Po Poor - Severe cracking, settling, or wetness NA No Basement

BsmtExposure: Refers to walkout or garden level walls

Gd Good Exposure Av Average Exposure (split levels or foyers typically score average or above) Mn Mimimum Exposure No No Exposure NA No Basement

BsmtFinType1: Rating of basement finished area

GLQ Good Living Quarters ALQ Average Living Quarters BLQ Below Average Living Quarters Rec Average Rec Room LwQ Low Quality Unf Unfinshed NA No Basement

BsmtFinSF1: Type 1 finished square feet

BsmtFinType2: Rating of basement finished area (if multiple types)

GLQ Good Living Quarters ALQ Average Living Quarters BLQ Below Average Living Quarters Rec Average Rec Room LwQ Low Quality Unf Unfinshed NA No Basement

BsmtFinSF2: Type 2 finished square feet

BsmtUnfSF: Unfinished square feet of basement area

TotalBsmtSF: Total square feet of basement area

Heating: Type of heating

Floor Floor Furnace GasA Gas forced warm air furnace GasW Gas hot water or steam heat Grav Gravity furnace OthW Hot water or steam heat other than gas Wall Wall furnace

HeatingQC: Heating quality and condition

Ex Excellent Gd Good TA Average/Typical Fa Fair Po Poor

CentralAir: Central air conditioning

N No Y Yes

Electrical: Electrical system

SBrkr Standard Circuit Breakers & Romex FuseA Fuse Box over 60 AMP and all Romex wiring (Average) FuseF 60 AMP Fuse Box and mostly Romex wiring (Fair) FuseP 60 AMP Fuse Box and mostly knob & tube wiring (poor) Mix Mixed

1stFlrSF: First Floor square feet

2ndFlrSF: Second floor square feet

LowQualFinSF: Low quality finished square feet (all floors)

GrLivArea: Above grade (ground) living area square feet

BsmtFullBath: Basement full bathrooms

BsmtHalfBath: Basement half bathrooms

FullBath: Full bathrooms above grade

HalfBath: Half baths above grade

Bedroom: Bedrooms above grade (does NOT include basement bedrooms)

Kitchen: Kitchens above grade

KitchenQual: Kitchen quality

Ex Excellent Gd Good TA Typical/Average Fa Fair Po Poor

TotRmsAbvGrd: Total rooms above grade (does not include bathrooms)

Functional: Home functionality (Assume typical unless deductions are warranted)

Typ Typical Functionality Min1 Minor Deductions 1 Min2 Minor Deductions 2 Mod Moderate Deductions Maj1 Major Deductions 1 Maj2 Major Deductions 2 Sev Severely Damaged Sal Salvage only

Fireplaces: Number of fireplaces

FireplaceQu: Fireplace quality

Ex Excellent - Exceptional Masonry Fireplace Gd Good - Masonry Fireplace in main level TA Average - Prefabricated Fireplace in main living area or Masonry Fireplace in basement Fa Fair - Prefabricated Fireplace in basement Po Poor - Ben Franklin Stove NA No Fireplace

GarageType: Garage location

2Types More than one type of garage Attchd Attached to home Basment Basement Garage BuiltIn Built-In (Garage part of house - typically has room above garage) CarPort Car Port Detchd Detached from home NA No Garage

GarageYrBlt: Year garage was built

GarageFinish: Interior finish of the garage

Fin Finished RFn Rough Finished Unf Unfinished NA No Garage

GarageCars: Size of garage in car capacity

GarageArea: Size of garage in square feet

GarageQual: Garage quality

Ex Excellent Gd Good TA Typical/Average Fa Fair Po Poor NA No Garage

GarageCond: Garage condition

Ex Excellent Gd Good TA Typical/Average Fa Fair Po Poor NA No Garage

PavedDrive: Paved driveway

Y Paved P Partial Pavement N Dirt/Gravel

WoodDeckSF: Wood deck area in square feet

OpenPorchSF: Open porch area in square feet

EnclosedPorch: Enclosed porch area in square feet

3SsnPorch: Three season porch area in square feet

ScreenPorch: Screen porch area in square feet

PoolArea: Pool area in square feet

PoolQC: Pool quality

Ex Excellent Gd Good TA Average/Typical Fa Fair NA No Pool

Fence: Fence quality

GdPrv Good Privacy MnPrv Minimum Privacy GdWo Good Wood MnWw Minimum Wood/Wire NA No Fence

MiscFeature: Miscellaneous feature not covered in other categories

Elev Elevator Gar2 2nd Garage (if not described in garage section) Othr Other Shed Shed (over 100 SF) TenC Tennis Court NA None

MiscVal: $Value of miscellaneous feature

MoSold: Month Sold (MM)

YrSold: Year Sold (YYYY)

SaleType: Type of sale

WD Warranty Deed - Conventional CWD Warranty Deed - Cash VWD Warranty Deed - VA Loan New Home just constructed and sold COD Court Officer Deed/Estate Con Contract 15% Down payment regular terms ConLw Contract Low Down payment and low interest ConLI Contract Low Interest ConLD Contract Low Down Oth Other

SaleCondition: Condition of sale

Normal Normal Sale Abnorml Abnormal Sale - trade, foreclosure, short sale AdjLand Adjoining Land Purchase Alloca Allocation - two linked properties with separate deeds, typically condo with a garage unit Family Sale between family members Partial Home was not completed when last assessed (associated with New Homes)

Downloaded from openml.org.

Feature Exercises

EXERCISE_START

What information is represented by BsmtFinType2?

Solution

Rating of basement finished area (if multiple types)

EXERCISE_START

What type of variable is BsmtFinType2 (categorical or numeric, then nominal/ordinal or discrete/continuous)?

Solution

categorical, ordinate

EXERCISE_START

What information is represented by GrLivArea?

Solution

Above grade (ground) living area square feet

EXERCISE_START

What type of variable is GrLivArea? (categorical or numeric, then nominal/ordinal or discrete/continuous)?

Solution

numeric, discrete

Load the Target (Response) Variable - Housing Price

import pandas as pd

housing_price_df = pd.DataFrame(housing.target) # load data into dataframe

housing_price_df.describe() # create numeric summary of that data

| SalePrice | |

|---|---|

| count | 1460.000000 |

| mean | 180921.195890 |

| std | 79442.502883 |

| min | 34900.000000 |

| 25% | 129975.000000 |

| 50% | 163000.000000 |

| 75% | 214000.000000 |

| max | 755000.000000 |

Price Exercises

EXERCISE_START

What is the range of housing prices in the dataset?

Solution

min: $34,900, max: $755,000

EXERCISE_START

Are the price data skewed? What distribution might you expect?

Solution

yes, positive/right handed skew. Expect positive/right handed skew from a long tail to outlier high values

Plot housing price values

import helper_functions

helper_functions.plot_salesprice(

housing_price_df,

# ylog=True

)

Summary

In this session we:

- Introduced the Ames Housing Dataset

- Determined the number of features and observations

- Understood some variables

- Viewed the ‘target variable’: SalePrice

Key Points

Predictive vs. explanatory regression

Overview

Teaching: 45 min

Exercises: 2 minQuestions

What are the two different goals to keep in mind when fitting machine learning models?

What kinds of questions can be answered using linear regresion?

How can we evaluate a model’s ability to capture a true signal/relationship in the data versus spurious noise?

Objectives

Review structure and goals of linear regression

Know when to use different model evaluation metrics for different modeling goals

Learn how to train and evaluate a predictive machine learning model

Understand how to detect underfitting and overfitting in a machine learning model

Linear Regression

Linear regression is a powerful technique that is often used to understand whether and how certain predictor variables (e.g., garage size, year built, etc.) in a dataset linearly relate to some target variable (e.g., house sale prices). Starting with linear models when working with high-dimensional data can offer several advantages including:

-

Simplicity and Interpretability: Linear models, such as linear regression, are relatively simple and interpretable. They provide a clear understanding of how each predictor variable contributes to the outcome, which can be especially valuable in exploratory analysis.

-

Baseline Understanding: Linear models can serve as a baseline for assessing the predictive power of individual features. This baseline helps you understand which features have a significant impact on the target variable and which ones might be less influential.

-

Feature Selection: Linear models can help you identify relevant features by looking at the estimated coefficients. Features with large coefficients are likely to have a stronger impact on the outcome, while those with small coefficients might have negligible effects

While linear models have their merits, it’s important to recognize that they might not capture complex (nonlinear) relationships present in the data. However, they are often the best option available when working in a high-dimensional context unless data is extremely limited.

Goals of Linear Regression

By fitting linear models to the Ames housing dataset, we can…

- Predict: Use predictive modeling to predict hypothetical/future sale prices based on observed values of the predictor variables in our dataset (e.g., garage size, year built, etc.).

- Explain: Use statistics to make scientific claims concerning which predictor variables have a significant impact on sale price — the target variable (a.k.a. response / dependent variable)

Terminology note: “target” and “predictor” synonyms

- Predictor = independent variable = feature = regressor

- Target = dependent variable = response = outcome

In this workshop, we will explore how we can exploit well-established machine learning methods, including feature selection, and regularization techniques (more on these terms later), to achieve both of the above goals on high-dimensional datasets.

To predict or explain. That is the question.

When trying to model data you use in your work, which goal is typically more prevalent? Do you typically care more about (1) accurately predicting some target variable or (2) making scientific claims concerning the existence of certain relationships between variables?

Solution

In a research setting, explaining relationships typically takes higher priority over predicting since explainations hold high value in science, but both goals are sometimes relevant. In industry, the reverse is typically true as many industry applications place predictive accuracy above explainability. We will explore how these goals align and sometimes diverge from one another throughout the remaining lessons.

Predicting housing prices with a single predictor

We’ll start with the first goal: prediction. How can we use regression models to predict housing sale prices? For clarity, we will begin this question through the lens of simple univariate regression models.

General procedure for fitting and evaluating predictive models

We’ll follow this general procedure to fit and evaluate predictive models:

- Extract predictor(s), X, and target, y, variables

- Preprocess the data: check for NaNs and extreme sparsity

- Visualize the relationship between X and y

- Transform target variable, if necessary, to get a linear relationship between predictors

- Train/test split the data

- Fit the model to the training data

-

Evaluate model

a. Plot the data vs predictions - qualitative assessment

b. Measure train/test set errors and check for signs of underfitting or overfitting

We’ll start by loading in the Ames housing data as we have done previously in this workshop.

from sklearn.datasets import fetch_openml

housing = fetch_openml(name="house_prices", as_frame=True, parser='auto') #

1) Extract predictor variable and target variable from dataframe

Next, we’ll extract the two variables we’ll use for our model — the target variable that we’ll attempt to predict (SalePrice), and a single predictor variable that will be used to predict the target variable. For this example, we’ll explore how well the “OverallQual” variable (i.e., the predictor variable) can predict sale prices.

OverallQual: Rates the overall material and finish of the house

10 Very Excellent

1 Very Poor

# Extract x (predictor) and y (target)

y = housing['target']

predictor = 'OverallQual'

x = housing['data'][predictor]

2) Preprocess the data

# remove columns with nans or containing > 97% constant values (typically 0's)

from preprocessing import remove_bad_cols

x_good = remove_bad_cols(x, 95)

0 columns removed, 1 remaining.

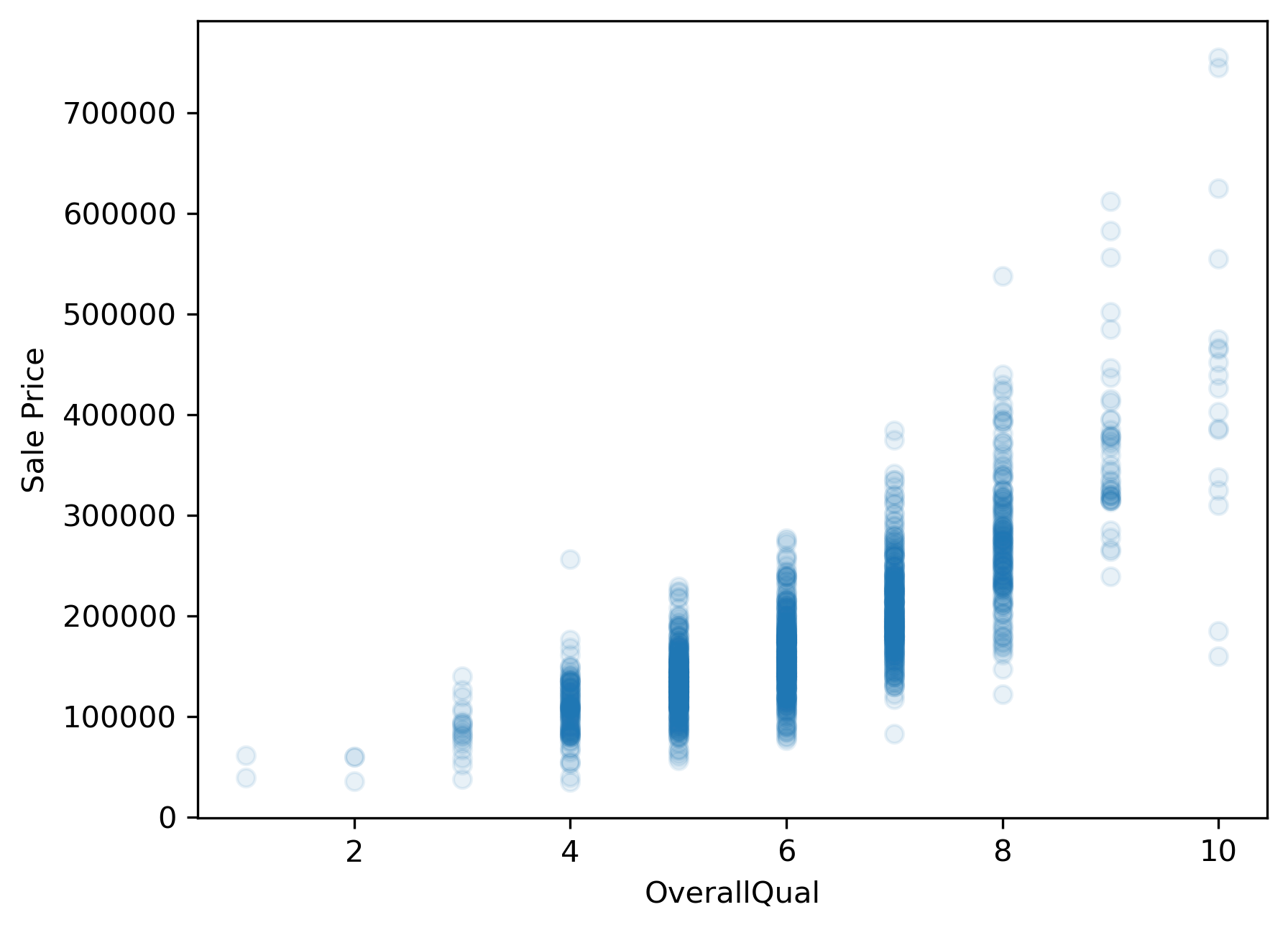

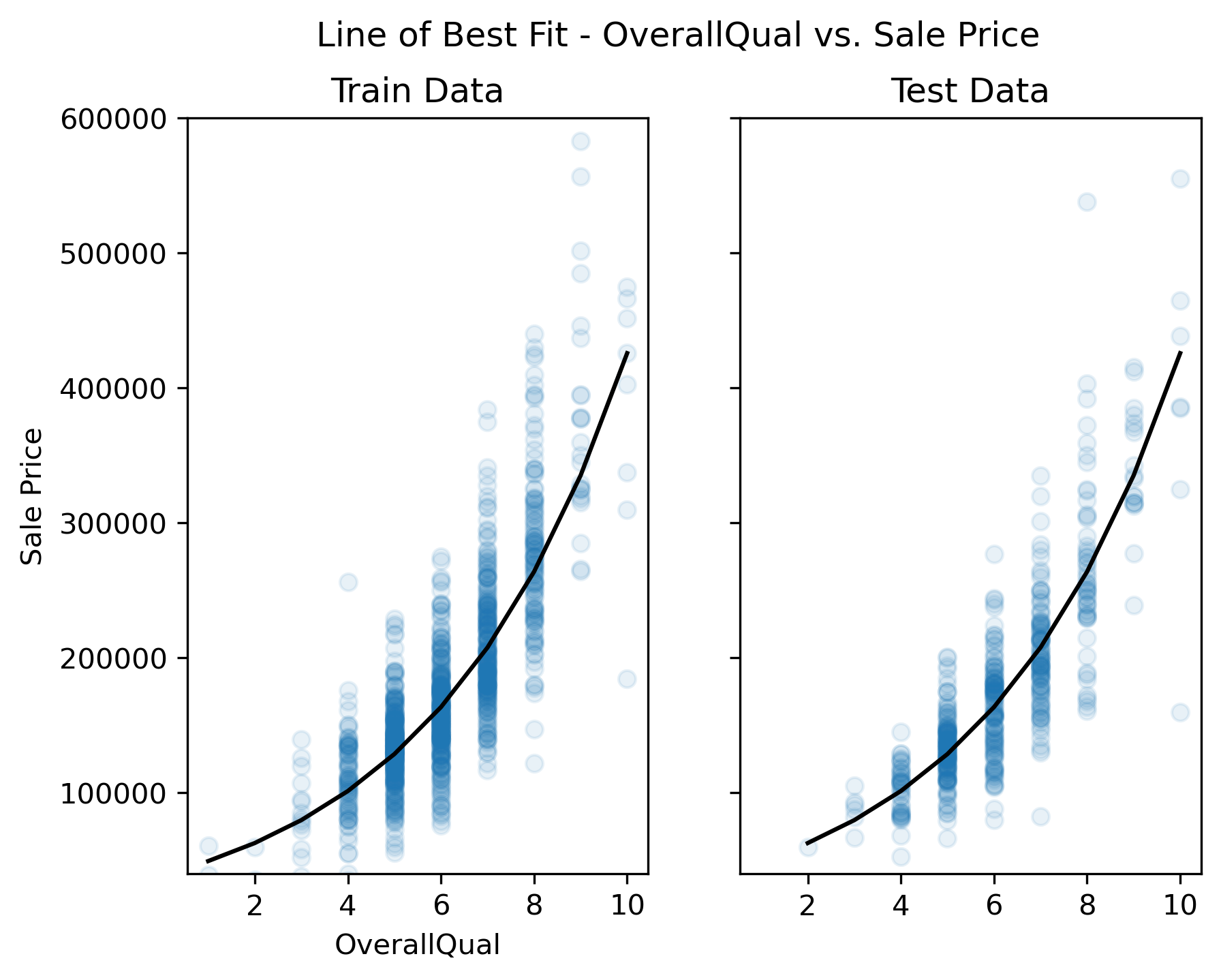

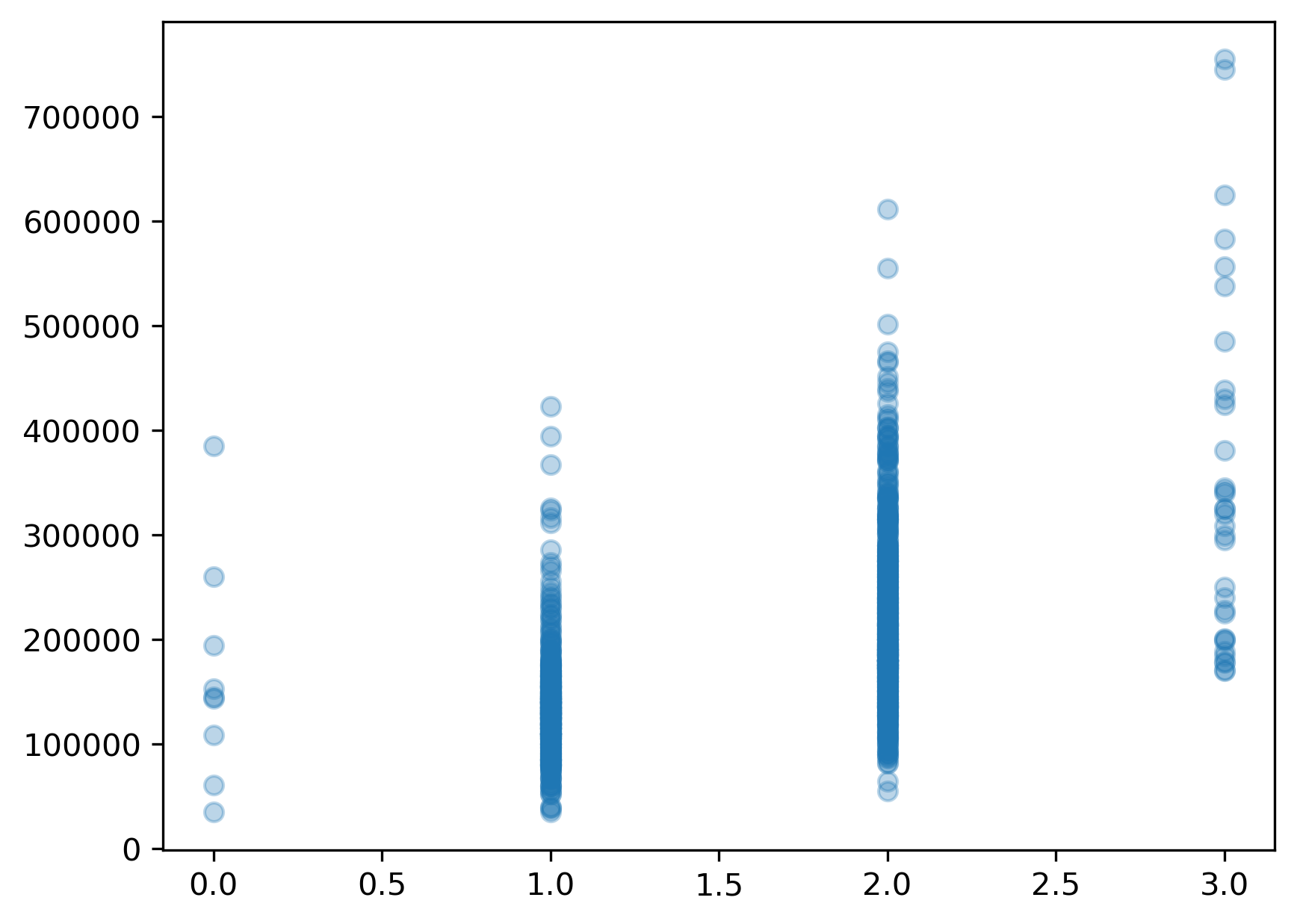

3) Visualize the relationship between x and y

Before fitting any models in a univariate context, we should first explore the data to get a sense for the relationship between the predictor variable, “OverallQual”, and the response variable, “SalePrice”. If this relationship does not look linear, we won’t be able to fit a good linear model (i.e., a model with low average prediction error in a predictive modeling context) to the data.

import matplotlib.pyplot as plt

plt.scatter(x,y, alpha=.1)

plt.xlabel(predictor)

plt.ylabel('Sale Price');

# plt.savefig('..//fig//regression//intro//scatterplot_x_vs_salePrice.png', bbox_inches='tight', dpi=300, facecolor='white');

4) Transform target variable, if necessary

Unfortunately, sale price appears to grow almost exponentially—not linearly—with the predictor variable. Any line we draw through this data cloud is going to fail in capturing the true trend we see here.

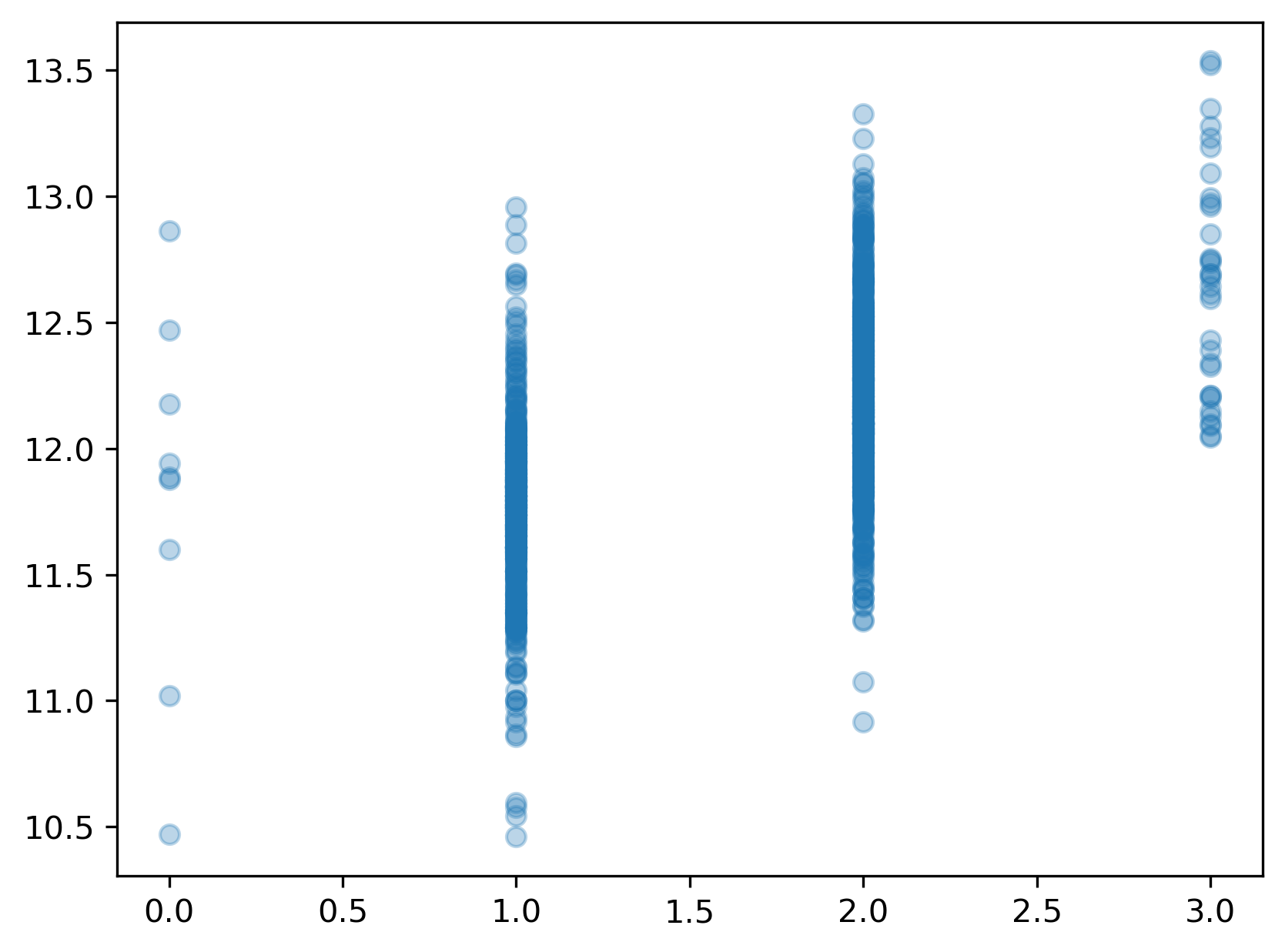

Log scaling

How can we remedy this situation? One common approach is to log transform the target variable. We’ll convert the “SalePrice” variable to its logarithmic form by using the math.log() function. Pandas has a special function called apply which can apply an operation to every item in a series by using the statement y.apply(math.log), where y is a pandas series.

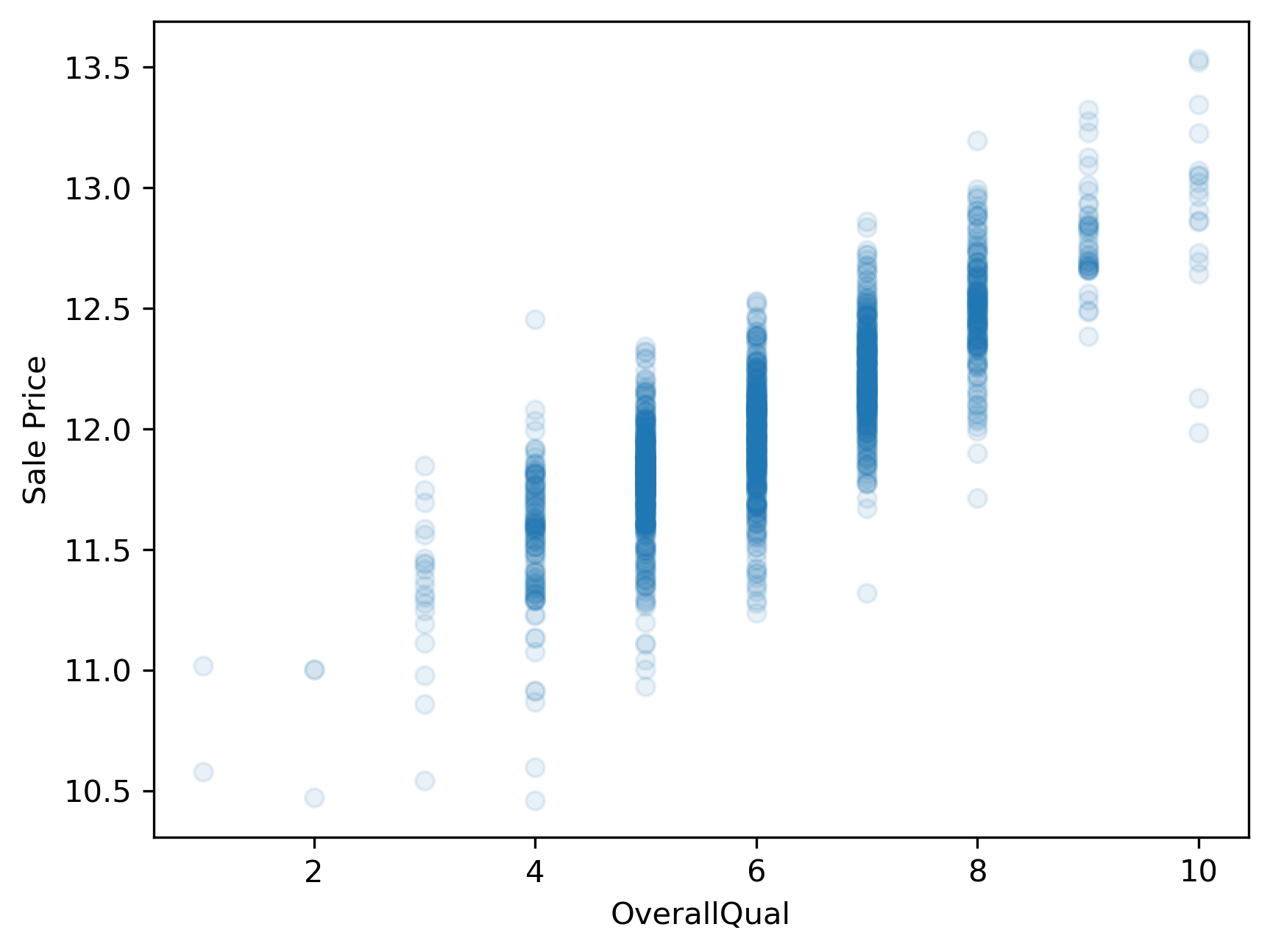

import numpy as np

y_log = y.apply(np.log)

plt.scatter(x,y_log, alpha=.1)

plt.xlabel(predictor)

plt.ylabel('Sale Price');

# plt.savefig('..//fig//regression//intro//scatterplot_x_vs_logSalePrice.png', bbox_inches='tight', dpi=300, facecolor='white')

This plot now shows a more linear appearing relationship between the target and predictor variables. Whether or not it is sufficiently linear can be addressed when we evaluate the model’s performance later.

5) Train/test split

Next, we will prepare two subsets of our data to be used for model-fitting and model evaluation. This process is standard for any predictive modeling task that involves a model “learning” from observed data (e.g., fitting a line to the observed data).

During the model-fitting step, we use a subset of the data referred to as training data to estimate the model’s coefficients (the slope of the model). The univariate model will find a line of best fit through this data.

Next, we can assess the model’s ability to generalize to new datasets by measuring its performance on the remaining, unseen data. This subset of data is referred to as the test data or holdout set. By evaluating the model on the test set, which was not used during training, we can obtain an unbiased estimate of the model’s performance.

If we were to evaluate the model solely on the training data, it could lead to overfitting. Overfitting occurs when the model learns the noise and specific patterns of the training data too well, resulting in poor performance on new data. By using a separate test set, we can identify if the model has overfit the training data and assess its ability to generalize to unseen samples. While overfitting is typically not likely to occur when using only a single predictor variable, it is still a good idea to use a train/test split when fitting univariate models. This can help in detecting unanticipated issues with the data, such as missing values, outliers, or other anomalies that affect the model’s behavior.

The below code will split our dataset into a training dataset containing 2/3 of the samples and a test set containing the remaining 1/3 of the data. We’ll discuss these different subsets in more detail in just a bit.

from sklearn.model_selection import train_test_split

x_train, x_test, y_train, y_test = train_test_split(x, y_log,

test_size=0.33,

random_state=0)

print(x_train.shape)

print(x_test.shape)

(978,)

(482,)

Reshape single-var predictor matrix in preparation for model-fitting step (requires a 2-D representation)

x_train = x_train.values.reshape(-1,1)

x_test = x_test.values.reshape(-1,1)

print(x_train.shape)

print(x_test.shape)

(978, 1)

(482, 1)

6) Fit the model to the training dataset

During the model fitting step, we use a subset of the data referred to as training data to estimate the model’s coefficients. The univariate model will find a line of best fit through this data.

The sklearn library

When fitting linear models solely for predictive purposes, the scikit-learn or “sklearn” library is typically used. Sklearn offers a broad spectrum of machine learning algorithms beyond linear regression. Having multiple algorithms available in the same library allows you to switch between different models easily and experiment with various techniques without switching libraries. Sklearn is also optimized for performance and efficiency, which is beneficial when working with large datasets. It can efficiently handle large-scale linear regression tasks, and if needed, you can leverage tools like NumPy and SciPy, which are well-integrated with scikit-learn for faster numerical computations.

from sklearn.linear_model import LinearRegression

reg = LinearRegression().fit(x_train,y_train)

7) Evaluate model

a) Plot the data vs predictions - qualitative assessment

y_pred_train=reg.predict(x_train)

y_pred_test=reg.predict(x_test)

from regression_predict_sklearn import plot_train_test_predictions

help(plot_train_test_predictions)

Help on function plot_train_test_predictions in module regression_predict_sklearn:

plot_train_test_predictions(predictors: List[str], X_train: Union[numpy.ndarray, pandas.core.series.Series, pandas.core.frame.DataFrame], X_test: Union[numpy.ndarray, pandas.core.series.Series, pandas.core.frame.DataFrame], y_train: Union[numpy.ndarray, pandas.core.series.Series], y_test: Union[numpy.ndarray, pandas.core.series.Series], y_pred_train: Union[numpy.ndarray, pandas.core.series.Series], y_pred_test: Union[numpy.ndarray, pandas.core.series.Series], y_log_scaled: bool, plot_raw: bool, err_type: Optional[str] = None, train_err: Optional[float] = None, test_err: Optional[float] = None) -> Tuple[Optional[matplotlib.figure.Figure], Optional[matplotlib.figure.Figure]]

Plot true vs. predicted values for train and test sets and line of best fit.

Args:

predictors (List[str]): List of predictor names.

X_train (Union[np.ndarray, pd.Series, pd.DataFrame]): Training feature data.

X_test (Union[np.ndarray, pd.Series, pd.DataFrame]): Test feature data.

y_train (Union[np.ndarray, pd.Series]): Actual target values for the training set.

y_test (Union[np.ndarray, pd.Series]): Actual target values for the test set.

y_pred_train (Union[np.ndarray, pd.Series]): Predicted target values for the training set.

y_pred_test (Union[np.ndarray, pd.Series]): Predicted target values for the test set.

y_log_scaled (bool): Whether the target values are log-scaled or not.

plot_raw (bool): Whether to plot raw or log-scaled values.

err_type (Optional[str]): Type of error metric.

train_err (Optional[float]): Training set error value.

test_err (Optional[float]): Test set error value.

Returns:

Tuple[Optional[plt.Figure], Optional[plt.Figure]]: Figures for true vs. predicted values and line of best fit.

(fig1, fig2) = plot_train_test_predictions(predictors=[predictor],

X_train=x_train, X_test=x_test,

y_train=y_train, y_test=y_test,

y_pred_train=y_pred_train, y_pred_test=y_pred_test,

y_log_scaled=True, plot_raw=True);

# print(type(fig1))

# import matplotlib.pyplot as plt

# import pylab as pl

# pl.figure(fig1.number)

# plt.savefig('..//fig//regression//intro//univariate_truePrice_vs_predPrice.png',bbox_inches='tight', dpi=300)

# pl.figure(fig2.number)

# fig2.savefig('..//fig//regression//intro//univariate_x_vs_predPrice.png',bbox_inches='tight', dpi=300)

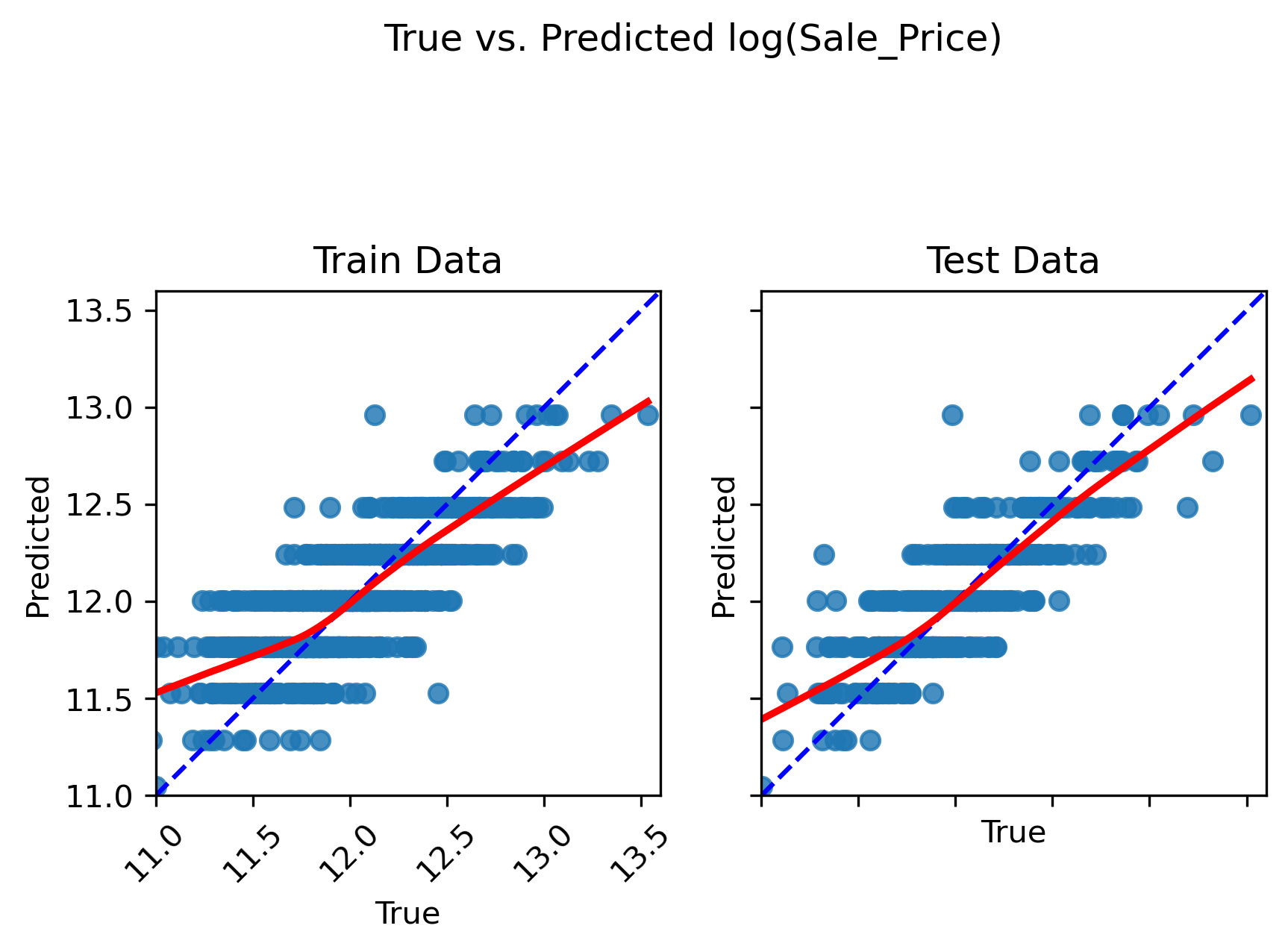

Inspect the plots

Does the model capture the variability in sale prices well? Would you use this model to predict the sale price of a house? Why or why not?

Does the model seem to exhibit any signs of overfitting? What about underfitting?

How might you improve the model?

Solution

Based on visual inspection, this linear model does a fairly good job in capturing the relationship between “OverallQual” and sale price. However, there is a tendency for the model to underpredict more expensive homes and overpredict less expensive homes.

Since the train and test set plots look very similar, overfitting is not a concern. Generally speaking, overfitting is not encountered with univariate models unless you have an incredily small number of samples to train the model on. Since the model follows the trajectory of sale price reasonably well, it also does not appear to underfit the data (at least not to an extreme extent).

In order to improve this model, we can ask ourselves — is “OverallQual” likely the only variable that contributes to final sale price, or should we consider additional predictor variables? Most outcome variables can be influenced by more than one predictor variable. By accounting for all predictors that have an impact on sales price, we can improve the model.

b) Measure train/test set errors and check for signs of underfitting or overfitting

While qualitative examinations of model performance are extremely helpful, it is always a good idea to pair such evaluations with a quantitative analysis of the model’s performance.

Convert back to original data scale There are several error measurements that can be used to measure a regression model’s performance. Before we implement any of them, we’ll first convert the log(salePrice) back to original sale price for ease of interpretation.

expY_train = np.exp(y_train)

pred_expY_train = np.exp(y_pred_train)

expY_test = np.exp(y_test)

pred_expY_test = np.exp(y_pred_test)

Measure baseline performance

from math import sqrt

import pandas as pd

baseline_predict = y.mean()

print('mean sale price =', baseline_predict)

# convert to series same length as y sets for ease of comparison

baseline_predict = pd.Series(baseline_predict)

baseline_predict = baseline_predict.repeat(len(y))

baseline_predict

mean sale price = 180921.19589041095

0 180921.19589

0 180921.19589

0 180921.19589

0 180921.19589

0 180921.19589

...

0 180921.19589

0 180921.19589

0 180921.19589

0 180921.19589

0 180921.19589

Length: 1460, dtype: float64

Root Mean Squared Error (RMSE): The RMSE provides an easy-to-interpret number that represents error in terms of the units of the target variable. With our univariate model, the “YearBuilt” predictor variable (a.k.a. model feature) predicts sale prices within +/- $68,106 from the true sale price. We always use the RMSE of the test set to assess the model’s ability to generalize on unseen data. An extremely low prediction error in the train set is also a good indicator of overfitting.

from sklearn import metrics

RMSE_baseline = metrics.mean_squared_error(y, baseline_predict, squared=False)

RMSE_train = metrics.mean_squared_error(expY_train, pred_expY_train, squared=False)

RMSE_test = metrics.mean_squared_error(expY_test, pred_expY_test, squared=False)

print(f"Baseline RMSE = {RMSE_baseline}")

print(f"Train RMSE = {RMSE_train}")

print(f"Test RMSE = {RMSE_test}")

Baseline RMSE = 79415.29188606751

Train RMSE = 45534.34940950763

Test RMSE = 44762.77229823455

Here, both train and test RMSE are very similar to one another. As expected with most univariate models, we do not see any evidence of overfitting. This model performs substantially better than the baseline. However, an average error of +/- $44,726 is likely too high for this model to be useful in practice. That is, the model is underfitting the data given its poor ability to predict the true housing prices.

Mean Absolute Percentage Error: What if we wanted to know the percent difference between the true sale price and the predicted sale price? For this, we can use the mean absolute percentage error (MAPE)…

Practice using helper function, measure_model_err

This code will be identical to the code above except for changing metrics.mean_squared_error to metrics.mean_absolute_percentage_error.

Rather than copying and pasting the code above, let’s try using one of the helper functions provided for this workshop.

from regression_predict_sklearn import measure_model_err

help(measure_model_err)

Help on function measure_model_err in module regression_predict_sklearn:

measure_model_err(y: Union[numpy.ndarray, pandas.core.series.Series], baseline_pred: Union[float, numpy.float64, numpy.float32, int, numpy.ndarray, pandas.core.series.Series], y_train: Union[numpy.ndarray, pandas.core.series.Series], y_pred_train: Union[numpy.ndarray, pandas.core.series.Series], y_test: Union[numpy.ndarray, pandas.core.series.Series], y_pred_test: Union[numpy.ndarray, pandas.core.series.Series], metric: str, y_log_scaled: bool) -> pandas.core.frame.DataFrame

Measures the error of a regression model's predictions on train and test sets.

Args:

y (Union[np.ndarray, pd.Series]): Actual target values for full dataset (not transformed)

baseline_pred (Union[float, np.float64, np.float32, int, np.ndarray, pd.Series]): Single constant or array of predictions equal to the length of y. Baseline is also not transformed.

y_train (Union[np.ndarray, pd.Series]): Actual target values for the training set.

y_pred_train (Union[np.ndarray, pd.Series]): Predicted target values for the training set.

y_test (Union[np.ndarray, pd.Series]): Actual target values for the test set.

y_pred_test (Union[np.ndarray, pd.Series]): Predicted target values for the test set.

metric (str): The error metric to calculate ('RMSE', 'R-squared', or 'MAPE').

y_log_scaled (bool): Whether the target values are log-scaled or not.

Returns:

pd.DataFrame: A DataFrame containing the error values for the baseline, training set, and test set.

error_df = measure_model_err(y=y, baseline_pred=baseline_predict,

y_train=expY_train, y_pred_train=pred_expY_train,

y_test=expY_test, y_pred_test=pred_expY_test,

metric='MAPE', y_log_scaled=False)

error_df.head()

| Baseline Error | Train Error | Test Error | |

|---|---|---|---|

| 0 | 0.363222 | 0.187585 | 0.16754 |

With the MAPE measurement (max value of 1 which corresponds to 100%), we can state that our model over/under estimates sale prices by an average of 23.41% (25.28%) across all houses included in the test set (train set). Certainly seems there is room for improvement based on this measure.

R-Squared: Another useful error measurement to use with regression models is the coefficient of determination $R^2$. Oftentimes pronounced simply “R-squared”, this measure assesses the proportion of the variation in the target variable that is predictable from the predictor variable(s). Using sklearn’s metrics, we can calculate this as follows:

error_df = measure_model_err(y=y, baseline_pred=baseline_predict,

y_train=expY_train, y_pred_train=pred_expY_train,

y_test=expY_test, y_pred_test=pred_expY_test,

metric='R-squared', y_log_scaled=False)

error_df.head()

| Baseline Error | Train Error | Test Error | |

|---|---|---|---|

| 0 | 0.0 | 0.666875 | 0.690463 |

Our model predicts 70.1% (65.2%) of the variance across sale prices in the test set (train set). The R-squared for the baseline model is 0 because the numerator and denominator in the equation for R-squared are equivalent:

R-squared equation: R-squared = 1 - (Sum of squared residuals) / (Total sum of squares)

Sum of Squared Residuals (SSR):

$SSR = \sum\left(Actual Value - Predicted Value\right)^2$ for all data points. The SSR is equivalent to the variance of the residuals in a regression model. Residuals are the differences between the actual observed values and the predicted values produced by the model. Squaring these differences and summing them up yields the SSR.

Total Sum of Squares (TSS):

$TSS = \sum\left(Actual Value - Mean of Actual Values\right)^2$ for all data points. The TSS represents the total variability or dispersion in the observed values of the target variable. It measures the total squared differences between each data point’s value and the mean of the observed values.

To read more about additional error/loss measurements, visit sklearn’s metrics documentation.

More on R-squared

Our above example model is able to explain roughly 70.1% of the variance in the test dataset. Is this a “good” value for R-squared?

Solution

The answer to this question depends on your objective for the regression model. This relates back to the two modeling goals of explaining vs predicting. Depending on the objective, the answer to “What is a good value for R-squared?” will be different.

Predicting the response variable: If your main objective is to predict the value of the response variable accurately using the predictor variable, then R-squared is important. The value for R-squared can range from 0 to 1. A value of 0 indicates that the response variable cannot be explained by the predictor variable at all. A value of 1 indicates that the response variable can be perfectly explained without error by the predictor variable. In general, the larger the R-squared value, the more precisely the predictor variables are able to predict the value of the response variable. How high an R-squared value needs to be depends on how precise you need to be for your specific model’s application. To find out what is considered a “good” R-squared value, you will need to explore what R-squared values are generally accepted in your particular field of study.

Explaining the relationship between the predictor(s) and the response variable: If your main objective for your regression model is to explain the relationship(s) between the predictor(s) and the response variable, the R-squared is mostly irrelevant. A predictor variable that consistently relates to a change in the response variable (i.e., has a statistically significant effect) is typically always interesting — regardless of the the effect size. The exception to this rule is if you have a near-zero R-squared, which suggests that the model does not explain any of the variance in the data.

Comparing univariate predictive models

Let’s see how well the other predictors in our dataset can predict sale prices. For simplicity, we’ll compare just continous predictors for now.

General procedure for comparing predictive models

We’ll follow this general procedure to compare models:

- Use

get_feat_types()to get a list of continuous predictors - Create an X variable containing only continuous predictors from

housing['data'] - Extract sale prices from

housing['target']and log scale it - Use the

remove_bad_colshelper function to remove predictors with nans or containing > 97% constant values (typically 0’s) - Perform a train/validation/test split using 60% of the data to train, 20% for validation (model selection), and 20% for final testing of the data

- Use the

compare_modelshelper function to quickly calculate train/validation errors for all possible single predictors. Returns adf_model_errdf that contains the following data stored for each predictor: ‘Predictor Variable’, ‘Train Error’, ‘Validation Error’. - Once selecting the best model, get the final assessment of the model’s generalizeability using the test set data

# preprocess

from preprocessing import get_feat_types

predictor_type_dict = get_feat_types()

continuous_fields = predictor_type_dict['continuous_fields']

X = housing['data'][continuous_fields]

y = housing['target']

y_log = np.log(y)

# remove columns with nans or containing > 97% constant values (typically 0's)

from preprocessing import remove_bad_cols

X_good = remove_bad_cols(X, 99)

4 columns removed, 30 remaining.

Columns removed: ['LotFrontage', 'MasVnrArea', 'GarageYrBlt', 'PoolArea']

# train/holdout split

X_train, X_holdout, y_train, y_holdout = train_test_split(X_good, y_log,

test_size=0.4,

random_state=0)

# validation/test split

X_val, X_test, y_val, y_test = train_test_split(X_holdout, y_holdout,

test_size=0.5,

random_state=0)

from regression_predict_sklearn import compare_models

help(compare_models)

Help on function compare_models in module regression_predict_sklearn:

compare_models(y: Union[numpy.ndarray, pandas.core.series.Series], baseline_pred: Union[numpy.ndarray, pandas.core.series.Series], X_train: pandas.core.frame.DataFrame, y_train: Union[numpy.ndarray, pandas.core.series.Series], X_val: pandas.core.frame.DataFrame, y_val: Union[numpy.ndarray, pandas.core.series.Series], predictors_list: List[List[str]], metric: str, y_log_scaled: bool, model_type: str, include_plots: bool, plot_raw: bool, verbose: bool) -> pandas.core.frame.DataFrame

Compare different models based on predictor variables and evaluate their errors.

Args:

y (Union[np.ndarray, pd.Series]): Target variable in its original scale (raw/untransformed).

baseline_pred (Union[np.ndarray, pd.Series]): Baseline predictions (in same scale as original target, y).

X_train (pd.DataFrame): Training feature data.

y_train (Union[np.ndarray, pd.Series]): Actual target values for the training set.

X_val (pd.DataFrame): Validation feature data.

y_val (Union[np.ndarray, pd.Series]): Actual target values for the validation set.

predictors_list (List[List[str]]): List of predictor variables for different models.

metric (str): The error metric to calculate.

y_log_scaled (bool): Whether the model was trained on log-scaled target values or not.

model_type (str): Type of the model being used.

include_plots (bool): Whether to include plots.

Returns:

pd.DataFrame: A DataFrame containing model errors for different predictor variables.

df_model_err = compare_models(y=y, baseline_pred=baseline_predict,

X_train=X_train, y_train=y_train,

X_val=X_val, y_val=y_val,

predictors_list=X_train.columns,

metric='RMSE', y_log_scaled=True,

model_type='unregularized',

include_plots=False, plot_raw=False, verbose=False)

df_model_err.head()

| Baseline Error | Train Error | Validation Error | Predictors | Trained Model | |

|---|---|---|---|---|---|

| 0 | 79415.291886 | 82875.380855 | 84323.189234 | LotArea | LinearRegression() |

| 1 | 79415.291886 | 67679.790920 | 69727.341057 | YearBuilt | LinearRegression() |

| 2 | 79415.291886 | 69055.741014 | 70634.285653 | YearRemodAdd | LinearRegression() |

| 3 | 79415.291886 | 45516.185542 | 46993.501006 | OverallQual | LinearRegression() |

| 4 | 79415.291886 | 81016.566207 | 84915.452252 | OverallCond | LinearRegression() |

from regression_predict_sklearn import compare_models_plot

sorted_predictors, train_errs, val_errs = compare_models_plot(df_model_err, 'RMSE');

Best model train error = 45516.18554163278

Best model validation error = 46993.501005708364

Worst model train error = 63479.544551733954

Worst model validation error = 220453.4404000341

Assess best model’s generalizeability

Get the final assessment of the model’s generalizeability using the test set data.

best_model = df_model_err.loc[df_model_err['Predictors']=='OverallQual', 'Trained Model'].item()

y_test_pred = best_model.predict(np.array(X_test['OverallQual']).reshape(-1,1))

test_err = metrics.mean_squared_error(np.exp(y_test), np.exp(y_test_pred), squared=False)

test_err

42298.77889761536

Examing the worst performers

df_model_err = compare_models(y=y, baseline_pred=baseline_predict,

X_train=X_train, y_train=y_train,

X_val=X_val, y_val=y_val,

predictors_list=sorted_predictors[-3:],

metric='RMSE', y_log_scaled=True,

model_type='unregularized',

include_plots=True, plot_raw=True, verbose=False)

df_model_err.head()

| Baseline Error | Train Error | Validation Error | Predictors | Trained Model | |

|---|---|---|---|---|---|

| 0 | 79415.291886 | 65085.562455 | 105753.386038 | 1stFlrSF | LinearRegression() |

| 1 | 79415.291886 | 60495.941297 | 106314.048186 | GrLivArea | LinearRegression() |

| 2 | 79415.291886 | 63479.544552 | 220453.440400 | TotalBsmtSF | LinearRegression() |

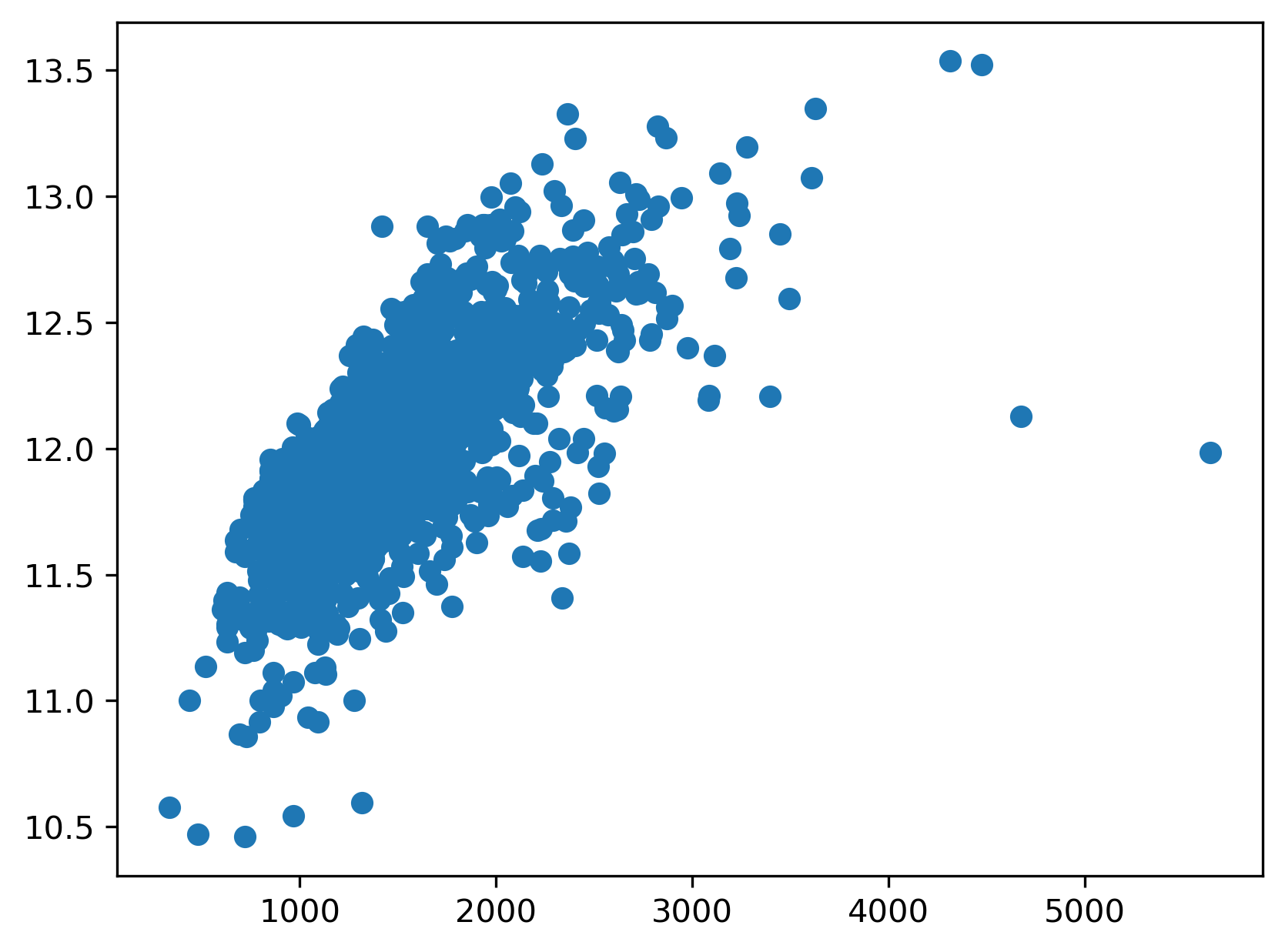

Outliers and interactions

It appears the worst performing predictors do not have much of a linear relationship with log(salePrice) and have some extreme outliers in the test set data. If we were only to focus on univariate models, we would want to remove these outliers after carefully considering their meaning and cause. However, outliers in a univariate context may not remain outliers in a multivariate context.

This point is further illustrated by the distributions / data clouds we see with the TotalBsmtSF predictor. The type of basement finish may change the relationship between TotalBsmtSF and SalePrice. If we fit a regression model that accounts for this interaction, the model will follow a linear pattern for each distribtuion separately. Similarly, certain outliers may stem from other predictors having interactions/relationships with one another. When searching for outliers, it is important to consider such multivariate interactions.

Fitting all predictors

Let’s assume all predictors in the Ames housing dataset are related to sale price to some extent and fit a multivariate regression model using all continuous predictors.

df_model_err = compare_models(y=y, baseline_pred=baseline_predict,

X_train=X_train, y_train=y_train,

X_val=X_val, y_val=y_val,

predictors_list=[X_train.columns],

metric='RMSE', y_log_scaled=True,

model_type='unregularized',

include_plots=True, plot_raw=True, verbose=True)

# of predictor vars = 30

# of train observations = 876

# of test observations = 292

Baseline RMSE = 79415.29188606751

Train RMSE = 34139.3449119712

Holdout RMSE = 134604.1997549234

(Holdout-Train)/Train: 294%

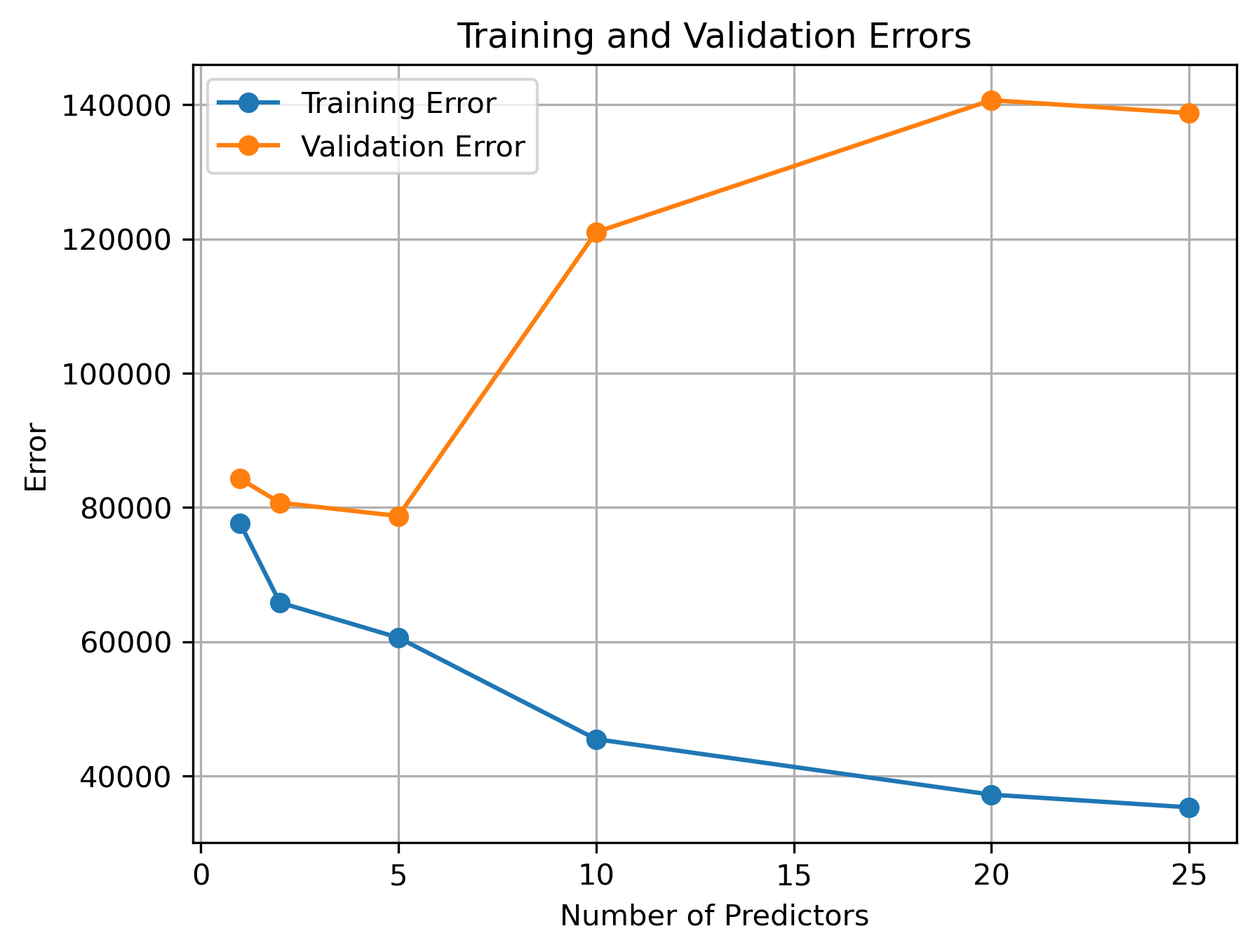

Compare permutations of models with different numbers of predictors

Let’s see how well we can predict house prices with different numbers of predictors.

from preprocessing import get_predictor_combos

sampled_combinations = get_predictor_combos(X_train=X_train, K=2, n=30)

print(sampled_combinations[0:2])

[['TotalBsmtSF', '3SsnPorch'], ['YearBuilt', 'OverallQual']]

Compare efficacy of different numbers of predictors

To quickly assess how well we can predict sale price with varying numbers of predictors, use the code we just prepared in conjunction with a for loop to determine the best train/validation errors possible when testing 30 permutations containing K=1, 2, 5, 10, and 25 predictors. Plot the results (K vs train/test errors). Is there any trend?

best_train_errs = []

best_val_errs = []

n_predictors = [1, 2, 5, 10, 20, 25]

for K in n_predictors:

print('K =', K)

sampled_combinations = get_predictor_combos(X_train=X_train, K=K, n=25)

df_model_err = compare_models(y=y, baseline_pred=baseline_predict,

X_train=X_train, y_train=y_train,

X_val=X_val, y_val=y_val,

predictors_list=sampled_combinations,

metric='RMSE', y_log_scaled=True,

model_type='unregularized',

include_plots=False, plot_raw=True, verbose=False)

sorted_predictors, train_errs, val_errs = compare_models_plot(df_model_err, 'RMSE')

best_train_errs.append(np.median(train_errs))

best_val_errs.append(np.median(val_errs))

K = 1

Best model train error = 45516.18554163278

Best model validation error = 46993.501005708364

Worst model train error = 63479.544551733954

Worst model validation error = 220453.4404000341

K = 2

Best model train error = 44052.332399325314

Best model validation error = 47836.516342128445

Worst model train error = 58691.19123135773

Worst model validation error = 215272.44855611687

K = 5

Best model train error = 43122.17607559138

Best model validation error = 45562.43051930849

Worst model train error = 62279.367627167645

Worst model validation error = 333222.31164330646

K = 10

Best model train error = 38240.57808718848

Best model validation error = 50883.52958766488

Worst model train error = 52066.92688665911

Worst model validation error = 357384.2570907179

K = 20

Best model train error = 33729.291727505

Best model validation error = 84522.32196428241

Worst model train error = 39417.4765728046

Worst model validation error = 189314.02234304545

K = 25

Best model train error = 33143.6127150748

Best model validation error = 96832.07020531746

Worst model train error = 38689.73868462601

Worst model validation error = 192248.540723152

plt.plot(n_predictors, best_train_errs, '-o', label='Training Error')

plt.plot(n_predictors, best_val_errs, '-o', label='Validation Error')

plt.xlabel('Number of Predictors')

plt.ylabel('Error')

plt.title('Training and Validation Errors')

plt.legend() # This adds the legend based on the labels provided above

plt.grid(True)

# Save the plot to a file

# plt.savefig('..//fig//regression//intro//Npredictor_v_error.png', bbox_inches='tight', dpi=300, facecolor='white')

How much data is needed per new predictor? 10X rule of thumb

As the number of observations begins to approach the number of model parameters (i.e., coefficients being estimated), the model will simply memorize the training data rather than learn anything useful. As a general rule of thumb, obtaining reliable estimates from linear regression models requires that you have at least 10X as many observations than model coefficients/predictors. The exact ratio may change depending on the variability of your data and whether or not each observation is truly independent (time-series models, for instance, often require much more data since observations are rarely independent).

Let’s see what the ratio is when we start to hit overfitting effects with our data. We need to determine the number of observations used to train the model as well as the number of estimated coefficients from the model (equal to number of predictors in this simple regression equation).

[X_train.shape[0] / n for n in n_predictors]

[876.0, 438.0, 175.2, 87.6, 43.8, 35.04]

With our data, we start to see overfitting effects even when we have as much as 87.6 times as many observations as estimated model coefficients. if you find that your regression model is more prone to overfitting that the “10X rule”, it could suggest that the training data might not be strictly independently and identically distributed (i.i.d.). Overfitting occurs when a model learns the noise and random fluctuations in the training data instead of the true underlying patterns, leading to poor generalization to new data.

The reasons for overfitting can vary including:

- Data Structure: If your data has inherent structure or dependencies that violate the i.i.d. assumption (e.g., temporal or spatial dependencies), your model might capture these patterns as noise and overfit to them.

- Outliers and Noise: If your data contains outliers or noisy observations, these can influence the model’s behavior and contribute to overfitting. This can be especially problematic with small datasets.

Univariate results as a feature selection method

Given the harsh reality of overfitting concerns, working in high-dimensional settings typical requires researchers to explore a number of “feature selection” methods. When working in strictly a predictive modeling context, you can use brute force methods to test different permutations of predictors. However, such permutation methods can become computationally expensive as the number of predictors begins to increase. One shortcut to brute force permutation testing is to select features based on their performance in a univariate modeling context.

X_train.shape

(876, 30)

from feature_selection import get_best_uni_predictors

top_features = get_best_uni_predictors(N_keep=5, y=y, baseline_pred=y.mean(),

X_train=X_train, y_train=y_train,

X_val=X_val, y_val=y_val,

metric='RMSE', y_log_scaled=True)

top_features

['OverallQual', 'GarageCars', 'YearBuilt', 'YearRemodAdd', 'FullBath']

from regression_predict_sklearn import fit_eval_model

help(fit_eval_model)

Help on function fit_eval_model in module regression_predict_sklearn:

fit_eval_model(y: Union[numpy.ndarray, pandas.core.series.Series], baseline_pred: Union[numpy.ndarray, pandas.core.series.Series], X_train: Union[numpy.ndarray, pandas.core.frame.DataFrame], y_train: Union[numpy.ndarray, pandas.core.series.Series], X_test: Union[numpy.ndarray, pandas.core.frame.DataFrame], y_test: Union[numpy.ndarray, pandas.core.series.Series], predictors: Union[str, List[str]], metric: str, y_log_scaled: bool, model_type: str, include_plots: bool, plot_raw: bool, verbose: bool, cv: int = None, alphas: Union[numpy.ndarray, List[float]] = None, max_iter: int = None) -> Tuple[float, float, float]

Fits a linear regression model using specified predictor variables and evaluates its performance.

Args:

... (existing arguments)

cv (int, optional): Number of cross-validation folds. Applicable when model_type is LassoCV.

alphas (Union[np.ndarray, List[float]], optional): List of alphas to tune the LassoCV model.

Applicable when model_type is LassoCV.

max_iter (int, optional): Maximum number of iterations for the LassoCV solver.

Returns:

Tuple[float, float, float]: Baseline error, training error, and test error.

fit_eval_model(y=y,baseline_pred=y.mean(), X_train=X_train, y_train=y_train,

X_test=X_test, y_test=y_test,

predictors=top_features,

metric='RMSE',

y_log_scaled=True,

model_type='unregularized',

include_plots=True,

plot_raw=True,

verbose=True);

# of predictor vars = 5

# of train observations = 876

# of test observations = 292

Baseline RMSE = 79415.29188606751

Train RMSE = 41084.668354744696

Holdout RMSE = 36522.31626858727

(Holdout-Train)/Train: -11%

7) Explaining models

At this point, we have assessed the predictive accuracy of our model. However, what if we want to interpret our model to understand which predictor(s) have a consistent or above chance (i.e., statistically significant) impact sales price? For this kind of question and other questions related to model interpretability, we need to first carefully validate our model. The next two episodes will explore some of the necessary checks you must perform before reading too far into your model’s estimations.

Key Points

Linear regression models can be used to predict a target variable and/or to reveal relationships between variables

Linear models are most effective when applied to linear relationships. Data transformation techniques can be used to help ensure that only linear relationships are modelled.

Train/test splits are used to assess under/overfitting in a model

Different model evaluation metrics provide different perspectives of model error. Some error measurements, such as R-squared, are not as relevant for explanatory models.

Model validity - relevant predictors

Overview

Teaching: 45 min

Exercises: 2 minQuestions

What are the benfits/costs of including additional predictors in a regression model?

Objectives

Understand the importance of including relevant predictors in a model.

Model Validity And Interpretation

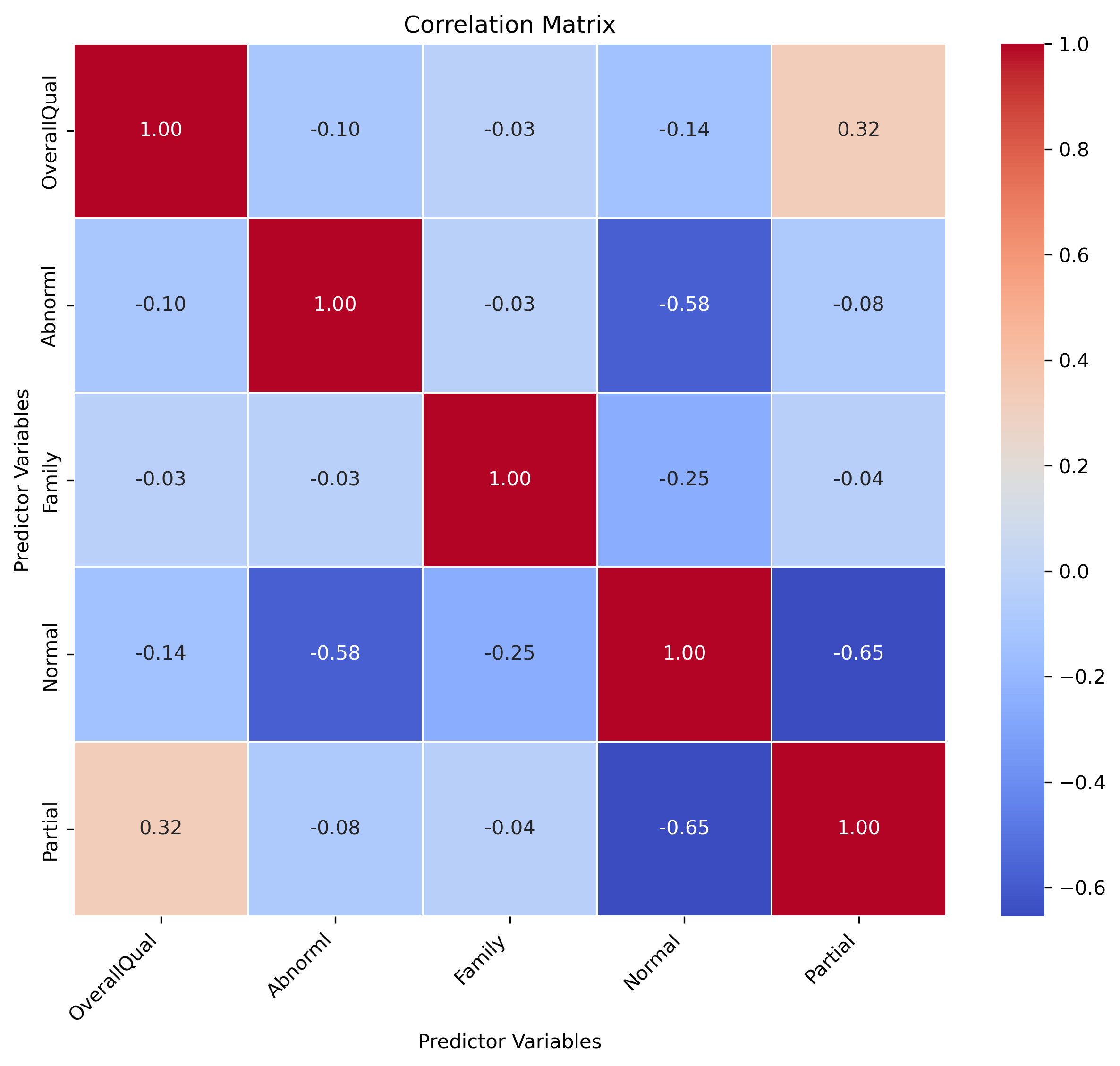

While using models strictly for predictive purposes is a completely valid approach for some domains and problems, researchers typically care more about being able to interpret their models such that interesting relationships between predictor(s) and target can be discovered and measured. When interpretting a linear regression model, we can look at the model’s estimated coefficients and p-values associated with each predictor to better understand the model. The coefficient’s magnitude can inform us of the effect size associated with a predictor, and the p-value tells us whether or not a predictor has a consistent (statistically significant) effect on the target.

Before we can blindly accept the model’s estimated coefficients and p-values, we must answer three questions that will help us determine whether or not our model is valid.

Model Validity Assessments

- Accounting for relevant predictors: Have we included all relevant predictors in the model?

- Bias/variance or under/overfitting: Does the model capture the variability of the target variable well? Does the model generalize well?

- Model assumptions: Does the fitted model follow the 5 assumptions of linear regression?

We will discuss the first two assessments in detail throughout this episode.

1. Relevant predictors

Benefits and drawbacks of including all relevant predcitors

What do you think might be some benefits of including all relevant predictors in a model that you intend to use to explain relationships? Are there any drawbacks you can think of?

Solution

Including all relevant predictor variables in a model is important for several reasons:

Improving model interpretability: Leaving out relevant predictors can result in model misspecification. Misspecification refers to a situation where the model structure or functional form does not accurately reflect the underlying relationship between the predictors and the outcome. If a relevant predictor is omitted from the model, the coefficients of the remaining predictors may be biased. This occurs because the omitted predictor may have a direct or indirect relationship with the outcome variable, and its effect is not accounted for in the model. Consequently, the estimated coefficients of other predictors may capture some of the omitted predictor’s effect, leading to biased estimates.

Improving predicitive accuracy and reducing residual variance: Omitting relevant predictors can increase the residual variance in the model. Residual variance represents the unexplained variation in the outcome variable after accounting for the predictors in the model. If a relevant predictor is left out, the model may not fully capture the systematic variation in the data, resulting in larger residuals and reduced model fit. While it is true that, in a research setting, we typically care more about being able to interpret our model than being able to perfectly predict the target variable, a model that severely underfits is still a cause for concern since the model won’t be capturing the variability of the data well enough to form any conclusions.

Robustness to future changes: This benefit only applies to predictive modeling tasks where models are often being fit to new data. By including all relevant predictors, the model becomes more robust to changes in the data or the underlying system. If a predictor becomes important in the future due to changes in the environment or additional data, including it from the start ensures that the model is already equipped to capture its influence.

Drawbacks to including all relevant predictors: While one should always aim to include as many relevant predictors as possible, this goal needs to be balanced with overfitting concerns. If we include too many predictors in the model and train on a limited number of observations, the model may simply memorize the nuances/noise in the data rather than capturing the underlying trend in the data.

Example

Let’s consider a regression model where we want to evaluate the relationship between FullBath (number of bathrooms) and SalePrice.

from sklearn.datasets import fetch_openml

housing = fetch_openml(name="house_prices", as_frame=True, parser='auto') #

y=housing['target']

X=housing['data']['FullBath']

print(X.shape)

X.head()

(1460,)

0 2

1 2

2 2

3 1

4 2

Name: FullBath, dtype: int64

It’s always a good idea to start by plotting the predictor vs the target variable to get a sense of the underlying relationship.

import matplotlib.pyplot as plt

plt.scatter(X,y,alpha=.3);

# plt.savefig('..//fig//regression//relevant_predictors//scatterplot_fullBath_vs_salePrice.png', bbox_inches='tight', dpi=300, facecolor='white');

Since the relationship doesn’t appear to be quite as linear as we were hoping, we will try a log transformation as we did in the previous episode.

import numpy as np

y_log = y.apply(np.log)

plt.scatter(X,y_log, alpha=.3);

# plt.savefig('..//fig//regression//relevant_predictors//scatterplot_fullBath_vs_logSalePrice.png', bbox_inches='tight', dpi=300, facecolor='white');

The log transform improves the linear relationship substantially!

Standardizing scale of predictors

We’ll compare the coefficients estimated from this model to an additional univariate model. To make this comparison more straightforward, we will z-score the predictor. If you don’t standardize the scale of all predictors being compared, the coefficient size will be a function of the scale of each specific predictor rather than a measure of each predictor’s overall influence on the target.

X = (X - X.mean())/X.std()

X.head()

0 0.789470

1 0.789470

2 0.789470

3 -1.025689

4 0.789470

Name: FullBath, dtype: float64

Statsmodels for model fitting and interpretation

Next, we will import the statsmodels package which is an R-style modeling package that has some convenient functions for rigorously testing and running stats on linear models.

For efficiency, we will skip train/test splits for now. Recall that train/test splits aren’t as essential when working with only a handful or predictors (i.e., when the ratio between number of training observations and model parameters/coefficients is at least 10).

Fit the model. Since we are now turning our attention towards explanatory models, we will use the statsmodels library isntead of sklearn. Statsmodels comes with a variety of functions which make it easier to interpret the model and ultimately run hypothesis tests. It closely mirrors the way R builds linear models.

import statsmodels.api as sm

# Add a constant column to the predictor variables dataframe - this acts as the y-intercept for the model

X = sm.add_constant(X)

X.head()

| const | FullBath | |

|---|---|---|

| 0 | 1.0 | 0.789470 |

| 1 | 1.0 | 0.789470 |

| 2 | 1.0 | 0.789470 |

| 3 | 1.0 | -1.025689 |

| 4 | 1.0 | 0.789470 |

Note: statsmodels is smart enough to not re-add the constant if it has already been added

X = sm.add_constant(X)

X.head()

| const | FullBath | |

|---|---|---|

| 0 | 1.0 | 0.789470 |

| 1 | 1.0 | 0.789470 |

| 2 | 1.0 | 0.789470 |

| 3 | 1.0 | -1.025689 |

| 4 | 1.0 | 0.789470 |

# Fit the multivariate regression model

model = sm.OLS(y_log, X)

results = model.fit()

Let’s print the coefs from this model. In addition, we can quickly extract R-squared from the statsmodel model object using…

print(results.params,'\n')

print(results.pvalues,'\n')

print('R-squared:', results.rsquared)

const 12.024051

FullBath 0.237582

dtype: float64

const 0.000000e+00

FullBath 2.118958e-140

dtype: float64

R-squared: 0.3537519976399338

You can also call results.summary() for a detailed overview of the model’s estimates and resulting statistics.

results.summary()

| Dep. Variable: | SalePrice | R-squared: | 0.354 |

|---|---|---|---|

| Model: | OLS | Adj. R-squared: | 0.353 |

| Method: | Least Squares | F-statistic: | 798.1 |

| Date: | Mon, 14 Aug 2023 | Prob (F-statistic): | 2.12e-140 |

| Time: | 21:14:09 | Log-Likelihood: | -412.67 |

| No. Observations: | 1460 | AIC: | 829.3 |

| Df Residuals: | 1458 | BIC: | 839.9 |

| Df Model: | 1 | ||

| Covariance Type: | nonrobust |

| coef | std err | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | 12.0241 | 0.008 | 1430.258 | 0.000 | 12.008 | 12.041 |

| FullBath | 0.2376 | 0.008 | 28.251 | 0.000 | 0.221 | 0.254 |

| Omnibus: | 51.781 | Durbin-Watson: | 1.975 |

|---|---|---|---|

| Prob(Omnibus): | 0.000 | Jarque-Bera (JB): | 141.501 |

| Skew: | 0.016 | Prob(JB): | 1.88e-31 |

| Kurtosis: | 4.525 | Cond. No. | 1.00 |

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

Based on the R-squared, this model explains 35.4% of the variance in the SalePrice target variable.